New infills post another strong month of sales activity with steady inventory levels, giving indication of an early Spring market this season.

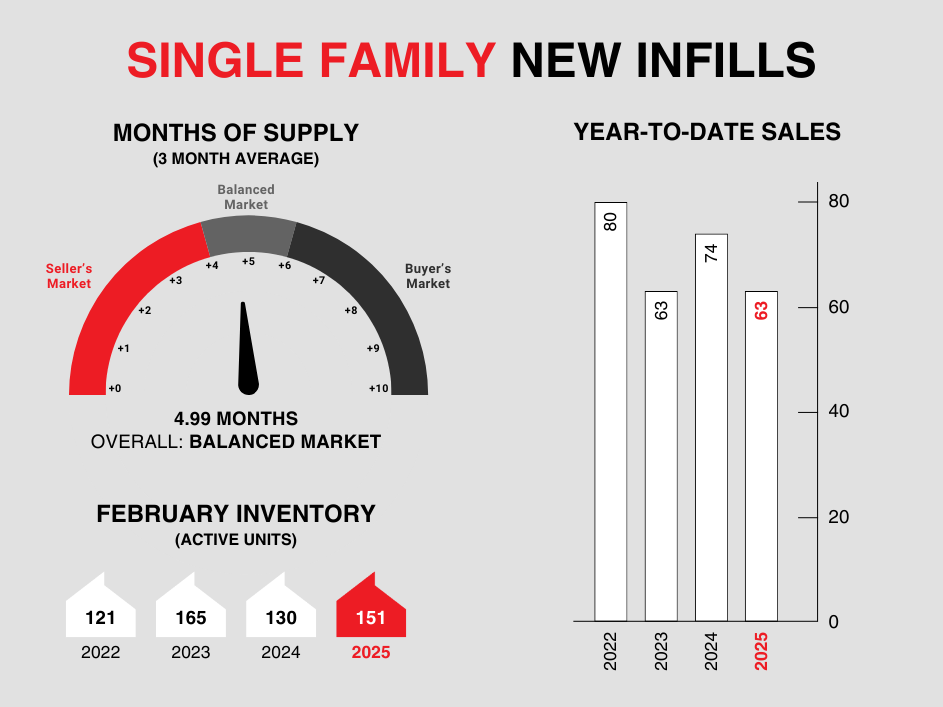

Single-family new infills posted 38 sales during the month of February, up from the 25 sales posted in January but lower than the 43 sales recorded in February of last year.

Single-family new infill inventory declined only slightly to 151 active listings for sale from 154 active listings recorded last month but is up from the 130 active listings recorded at this time last year. Single-family new infills are currently averaging 4.99 months of supply compared to 4.32 months of supply from this time last year (3-month averages).

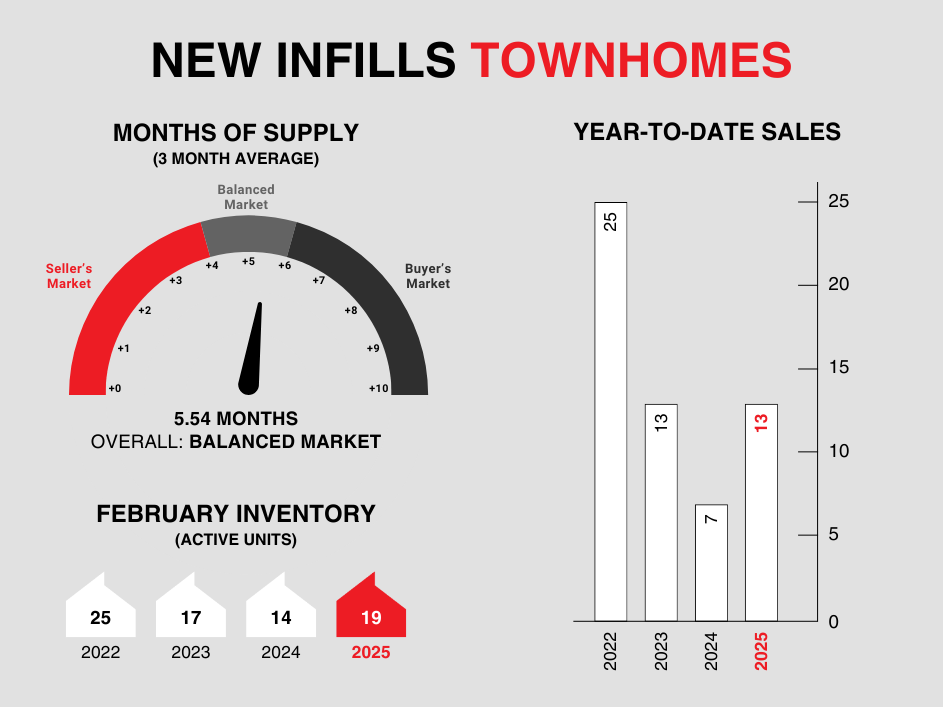

New infill townhomes posted 9 sales during the month of February, up considerably from the 4 sales recorded in January and also up from the 6 sales recorded in February of last year.

New infill townhome inventory declined to 19 active units for sale from 24 active units recorded last month but is up from the 14 active units recorded at this time last year.

New infill townhomes are currently averaging 5.54 months of supply compared to 5.00 months of supply from this time last year (3-month averages).

Although many markets throughout Canada are experiencing headwinds in the real estate sector, Calgary is bucking the trend with healthy sales activity and reasonable inventory levels. With another highly anticipated rate cut around the corner, we anticipate the new infill sector to maintain its healthy momentum over the coming months.

CALGARY MARKET UPDATE (CREB)

City of Calgary, March 3, 2025 - Inventory levels saw substantial year-over-year growth for the second month in a row, rising by 76 per cent to 4,145 units in February. While inventory increases were seen across all price ranges, the largest increases were in homes priced under $500,000.

The increase was driven by substantial growth in the more affordable apartment and row/townhouse sectors. The overall months of supply was 2.4 in February, similar to last month but more than double this time last year. Apartment-style units remained the most well-supplied at 3.1 months.

There were 1,721 sales in February, which was above historical averages for the month but 19 per cent lower than levels seen last year and significantly lower than the record levels seen in the post-pandemic period. New Listings in February reached 2,830, roughly in line with historical averages for the month. The sales-to-new listings ratio for the month was 61 per cent, higher than historical averages but below levels seen in each of the last three years.

“Even though more people listed their homes for sale, there were actually fewer sales than in February 2024. So, we’re seeing the seller’s market of the past two or three years ease off,” said Alan Tennant, President and CEO of CREB®. “In turn, that’s caused the pace at which prices are increasing to slow down a bit, which should come as welcome news for buyers.”

The total residential unadjusted benchmark price in February was $587,600, relatively stable compared to late-2024 and roughly one per cent higher year-over-year. Price changes varied across the city, with the City Centre and North districts seeing declines, while the East district saw the largest price growth at over three per cent.