Both single-family and new infill townhomes had a strong month this January, with sales and inventory rising ahead of this year's Spring market.

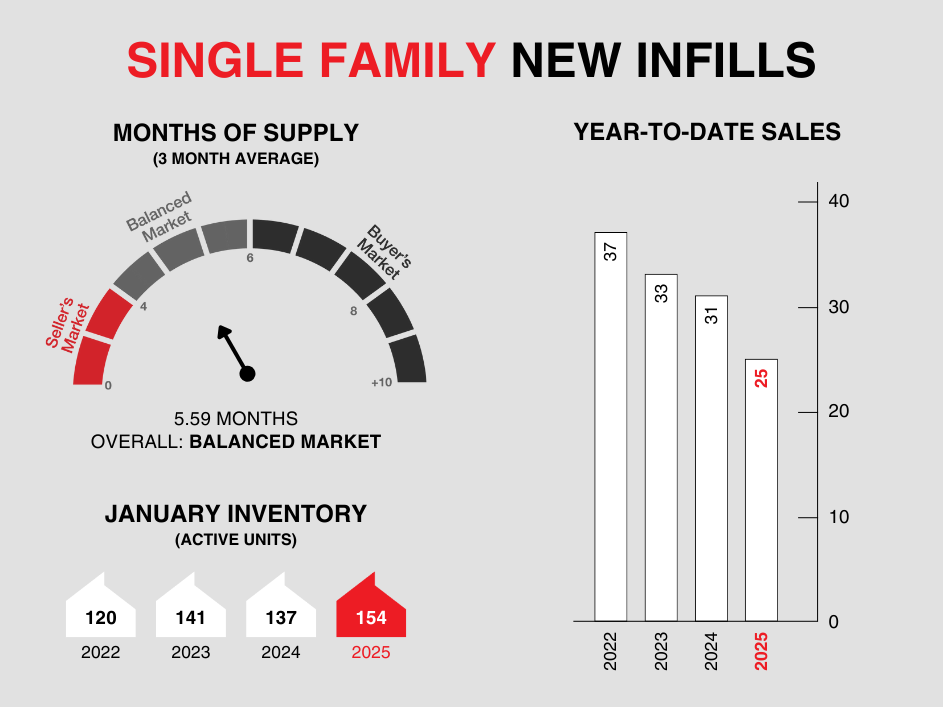

Single-family new infills posted 25 sales during the month of January, slightly up from the 24 sales posted in December, however, lower than the 31 sales recorded in January of last year.

Single-family new infill inventory increased in January, to 154 active listings for sale, from 129 active listings recorded last month, and up from the 137 active listings recorded at this time last year. Single-family new infills are currently averaging 5.59 months of supply compared to 6.39 months of supply from this time last year (3-month averages).

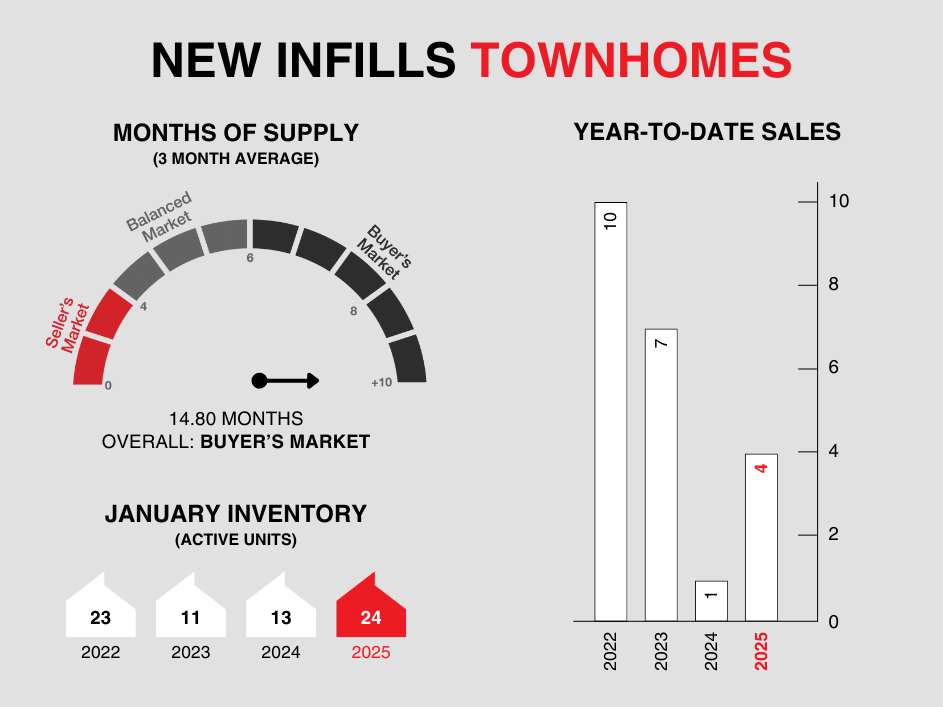

New infill townhomes posted 4 sales during the month of January, up considerably from no sales recorded in December, only 1 sale recorded in November of last year and only 1 sale recorded in January of last year.

New infill townhome inventory declined, to 24 active units for sale, from 29 active units recorded last month, but is up considerably from the 13 active units recorded at this time last year. New infill townhomes are currently averaging 14.8 months of supply compared to 8.25 months of supply from this time last year (3-month averages).

Sellers seem eager to get their inventory to market as inventory levels in the overall market inches upwards and political uncertainty enters the conversation. On the flip side, Buyers who have been patiently waiting to purchase become further incentivized with more options to consider and declining interest rates.

CALGARY MARKET UPDATE (CREB)

City of Calgary, February 3, 2025 - Following three consecutive years of limited supply choice, inventory levels in January rose to 3,639 units. While the 70 percent year-over-year gain is significant, inventory levels remain lower than the over 4,000 units we would typically see in January. Inventories rose across all property types, with some of the largest gains driven by apartment-style condominiums.

“Supply levels are expected to improve this year, contributing to more balanced conditions and slower price growth,” said Ann-Marie Lurie, Chief Economist at CREB®. “However, the adjustment in supply is not equal amongst all property types. Compared with sales, we continue to see persistently tight conditions for detached, semi-detached and row properties while apartment condominiums show signs of excess supply for higher priced units.”

Citywide, the months of supply reached 2.5 months in January, an improvement over the one month of supply reported last year, but it is still considered low for a winter month. The month of supply ranged from under two months for semi-detached properties to 3.5 months for apartment-style units.

Rising supply resulted from a boost in new listings compared to sales. New listings rose to 2,896 units in January, compared to 1,451 sales. Sales in January were down by 12 percent compared to last year. However, even with a pullback in sales, levels remained nearly 30 percent higher than levels typically recorded in January.

The total residential benchmark price in January was $583,000, which is relatively stable compared to levels reported at the end of last year and nearly three percent higher than last January. Price growth ranged across districts within the city as well as property types.