As expected, new infill sales declined during the month of December, with inventories receding as expected in the single-family segment while inventories actually grew in the townhome segment.

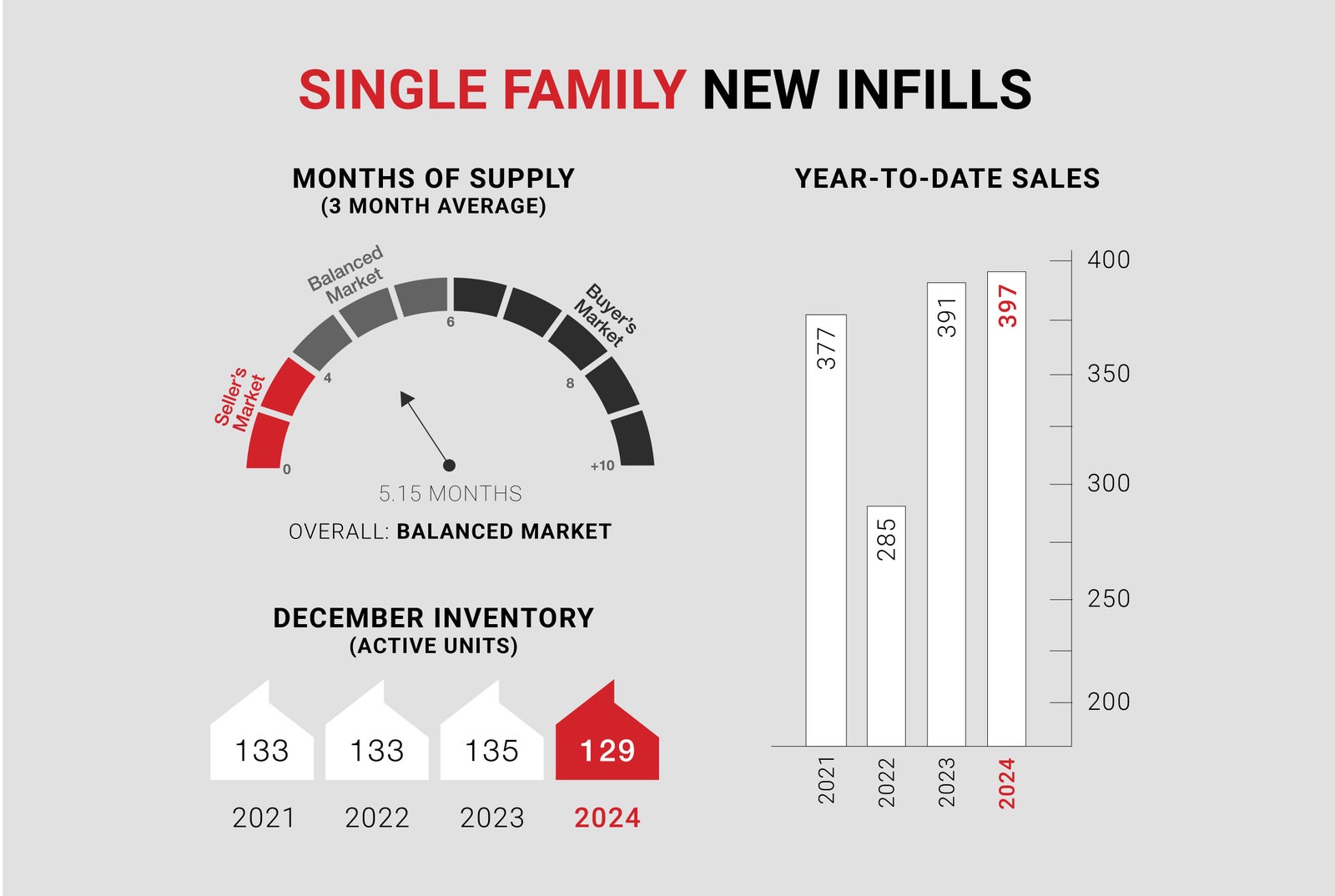

Single-family new infills posted 24 sales during the month of December, down from the 31 sales posted last month, however up from the 19 sales recorded in December of last year. Total single-family sales in 2024 were 397, up slightly from the 391 sales posted in 2023.

Single-family new infill inventory declined further in December to 129 active listings for sale, from 164 active listings recorded last month, and is also down from the 135 active listings recorded at this time last year. Monthly inventory in 2024 averaged 133 compared to 151 in 2023.

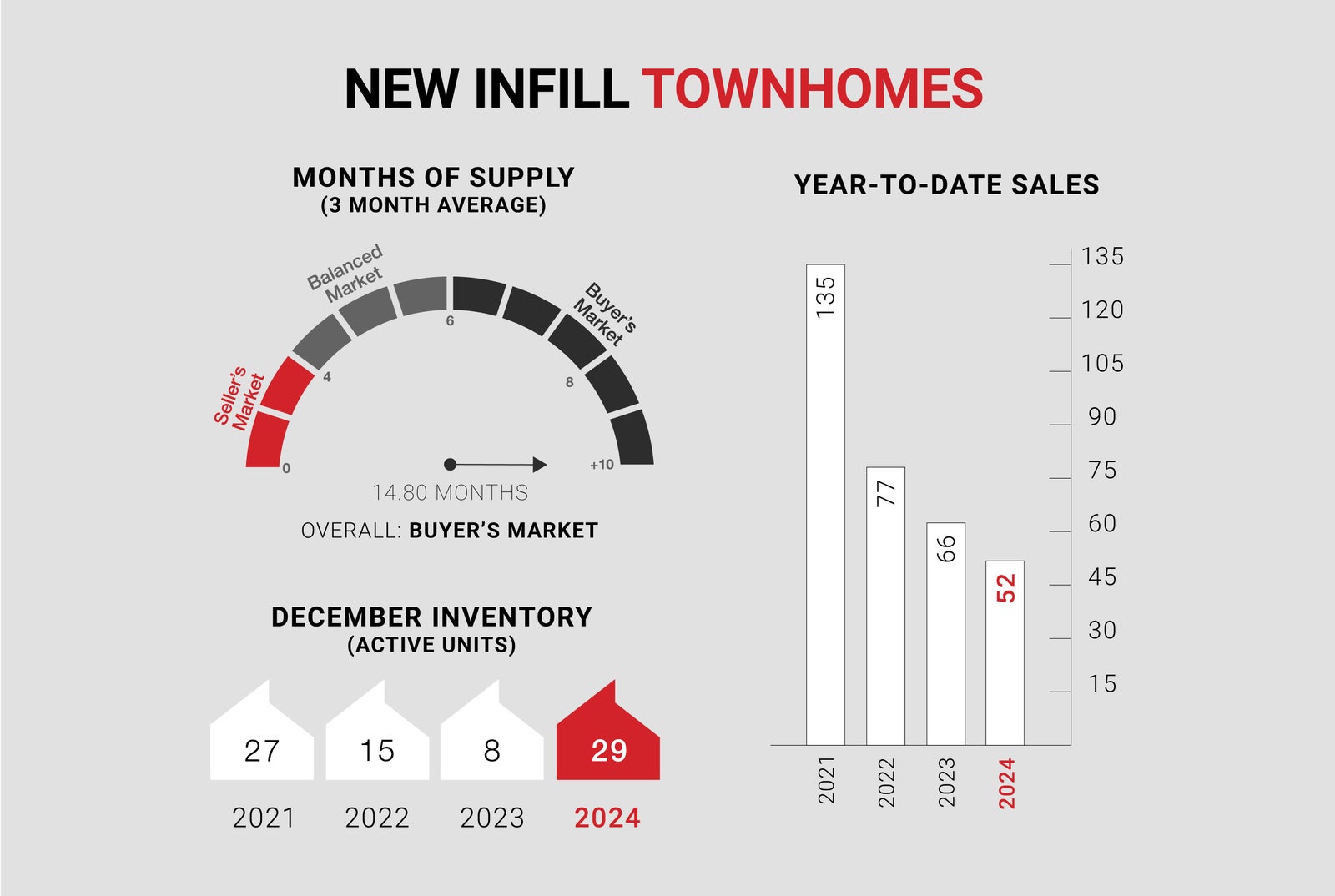

New infill townhomes posted no sales during the month of December, compared to only a single sale recorded last month, which was on par with no sales posted in December of last year. The total new infill townhome sales in 2024 were 52 compared to 66 sales recorded in 2023.

New infill townhome inventory increased to 29 active units for sale from 21 active units recorded last month and is up considerably from the 8 active units recorded at this time last year. Monthly inventory in 2024 averaged 19 units for sale compared to only 14 units for sale in 2023.

Sales activity is anticipated to resume to healthy levels in the coming weeks, with the potential for an early Spring market due to pent-up demand and further declining interest rates.

From all of us at the URBAN UPGRADE & NEWINFILLS team, Happy New Year!

CALGARY MARKET UPDATE (CREB)

City of Calgary, Jan 2, 2025 - The year ended with 1,322 sales in December, a three percent decline over last year but nearly 20 percent higher than long-term trends. Overall sales in 2024 were just shy of last year’s levels, as gains for higher-priced homes offset pullbacks in the lower price ranges caused by supply challenges.

“Population gains over the past several years have supported sales activity that has outperformed long-term trends. In 2024, sales would likely have been higher if there was more supply choice, especially in the lower price ranges,” said Ann-Marie Lurie, Chief Economist at CREB®. “That being said, we did start to see shifts occurring in the market in the second half of the year as supply levels started to improve for higher priced homes.”

As of December, there were 2,989 units available in inventory, still below long-term trends for the month but a significant improvement over the lower levels reported last December and levels reported early this year. Improved rental choice and significant gains in new home activity helped boost new listings in the resale market, driving higher inventories in the year's second half.

While conditions vary depending on price range and property type, more housing options have helped to take some of the pressure off home prices, which stabilized in the second half of the year following steep gains in the spring. Overall, on an annual basis, total residential benchmark prices improved by over seven percent.

As we move into 2025, supply will continue to be a dominant theme. However, how they impact prices will ultimately depend on the type of supply being added and how demand holds up in the face of a changing economic climate. On January 21, CREB® will release its forecast report, highlighting the expectations and risks facing the market in the coming year.