New infill sales resume their steady pace as they enter this year’s winter season.

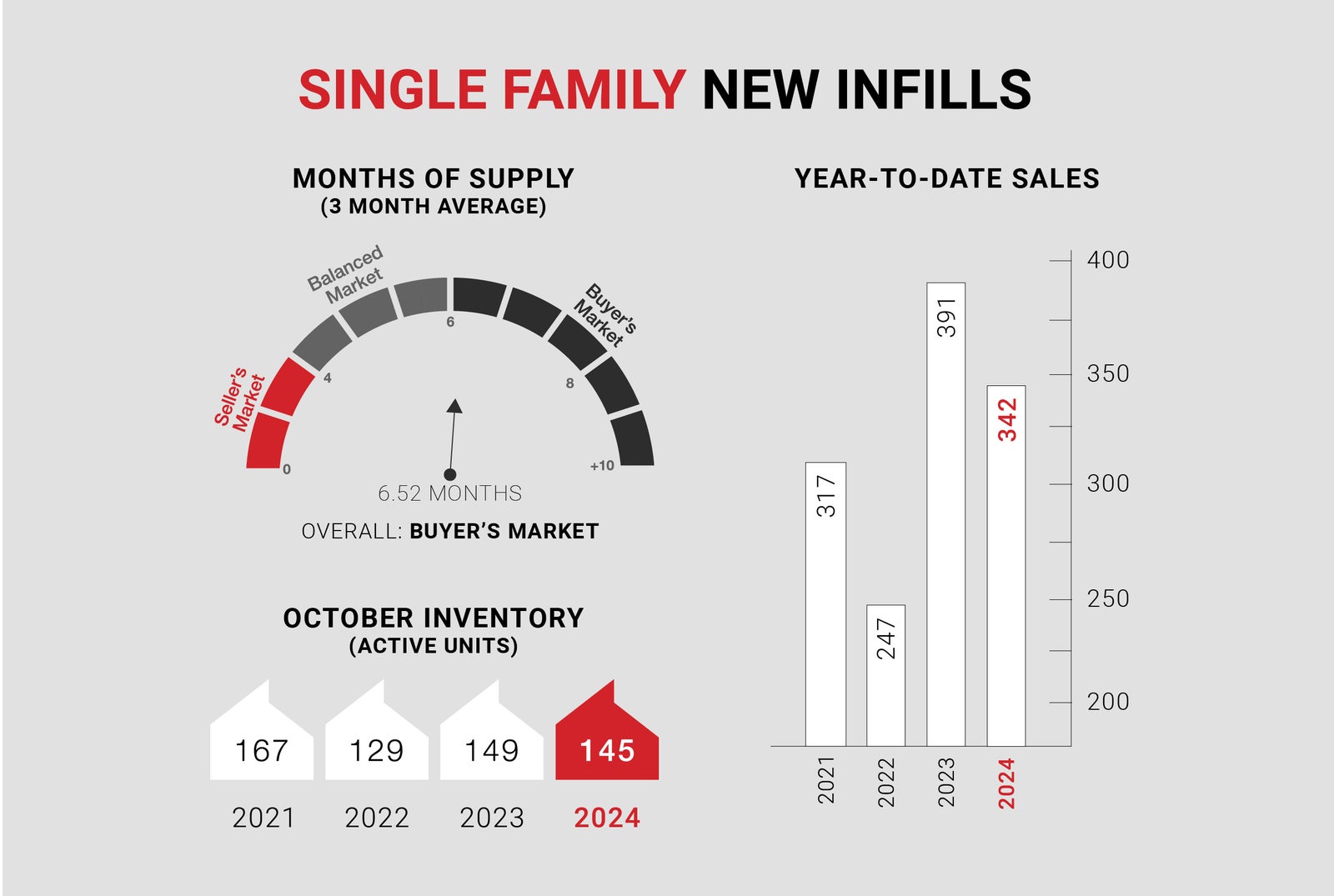

Single-family new infills posted 30 sales during the month of October, up considerably from the 20 sales posted last month and more in line with the 29 sales recorded in November of last year.

Single-family new infill inventory has eased slightly to 145 active listings for sale from the 151 active listings recorded last month and is also down from the 149 active listings recorded at this time last year.

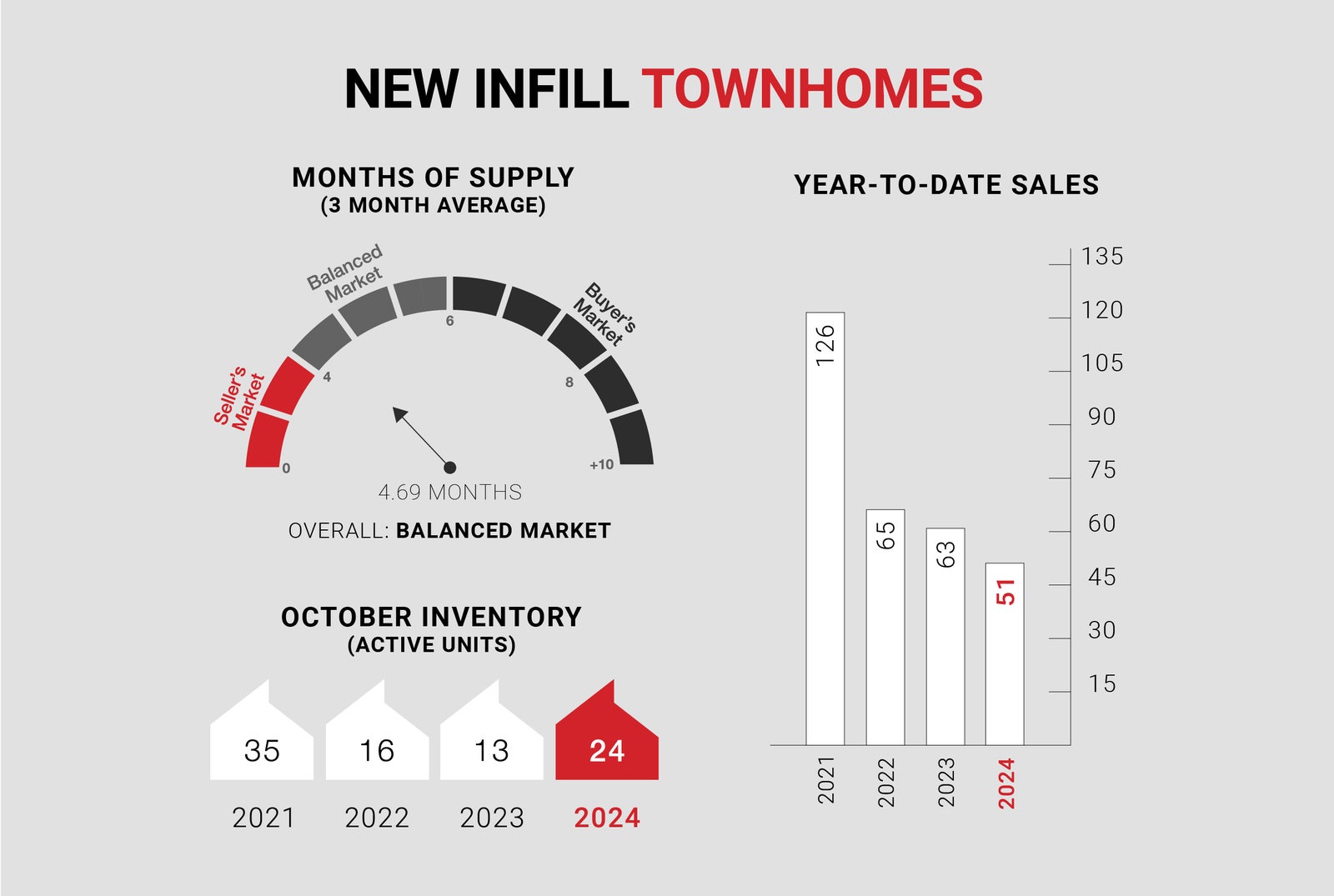

New infill townhomes posted 4 sales during the month of October, down slightly from the 5 sales recorded last month and on par with sales recorded in November of last year.

New infill townhome inventory has increased to 24 active units for sale from the 19 active units recorded last month and is also up from the 13 active units recorded at this time last year.

We expect New Infill markets to remain relatively calm until the New Year, given typical seasonal behaviour and a lack of urgency from competing buyers.

This pent-up demand will likely result in a heated early Spring market that is further fuelled by lower borrowing rates and supply levels that once again aren’t able to keep up.

CALGARY MARKET UPDATE (CREB)

City of Calgary, November 1, 2024 - Sales gains for homes priced above $600,000 offset declines at the lower end of the market, resulting in October sales that were similar to last year. The 2,174 sales in October increased over September and stood 24 percent above long-term trends for the month.

"Housing demand has stayed relatively strong in our market as we move into the fourth quarter, with October sales rising over last month," said Ann-Marie Lurie, Chief Economist at CREB®. "However, activity would likely have been stronger if more supply choices existed for lower-priced homes. Supply levels in our market are improving relative to the ultra-low levels experienced last year, but much of the gains have been driven by higher-priced units for each property type. This results in conditions far more balanced in the upper end of the market versus the seller's market conditions in the lower to mid-price ranges of each property type."

The gains in new listings relative to sales over the past six months have supported inventory gains in the city. As of October, 4,966 units were available, a significant improvement over the near-record low of 3,205 units reported last October. While inventories are starting to reach levels more consistent with long-term trends, the inventory composition has changed as nearly half of all the residential inventory is now priced above $600,000.

Adjustments in supply are helping move the market away from the tight market conditions experienced in the spring. However, conditions remain relatively tight, with 2.3 months of supply and a 67 percent sales-to-new listings ratio, and the months of supply do vary significantly by price range and property type. For example, detached homes priced below $700,000 are reporting less than two months of supply, while homes priced over $1,000,000 are reporting over three months of supply. This is likely resulting in different price pressures depending on price range and property type.

Overall, the total residential benchmark price was $592,500 in October, over four percent higher than last October and on a year-to-date basis, averaging over eight percent higher than last year's levels. The unadjusted benchmark prices did ease slightly over last month due to seasonal factors, as seasonally adjusted prices remained relatively stable in October compared to September.