New infill sales ease, and inventories increase as Summer comes to an end.

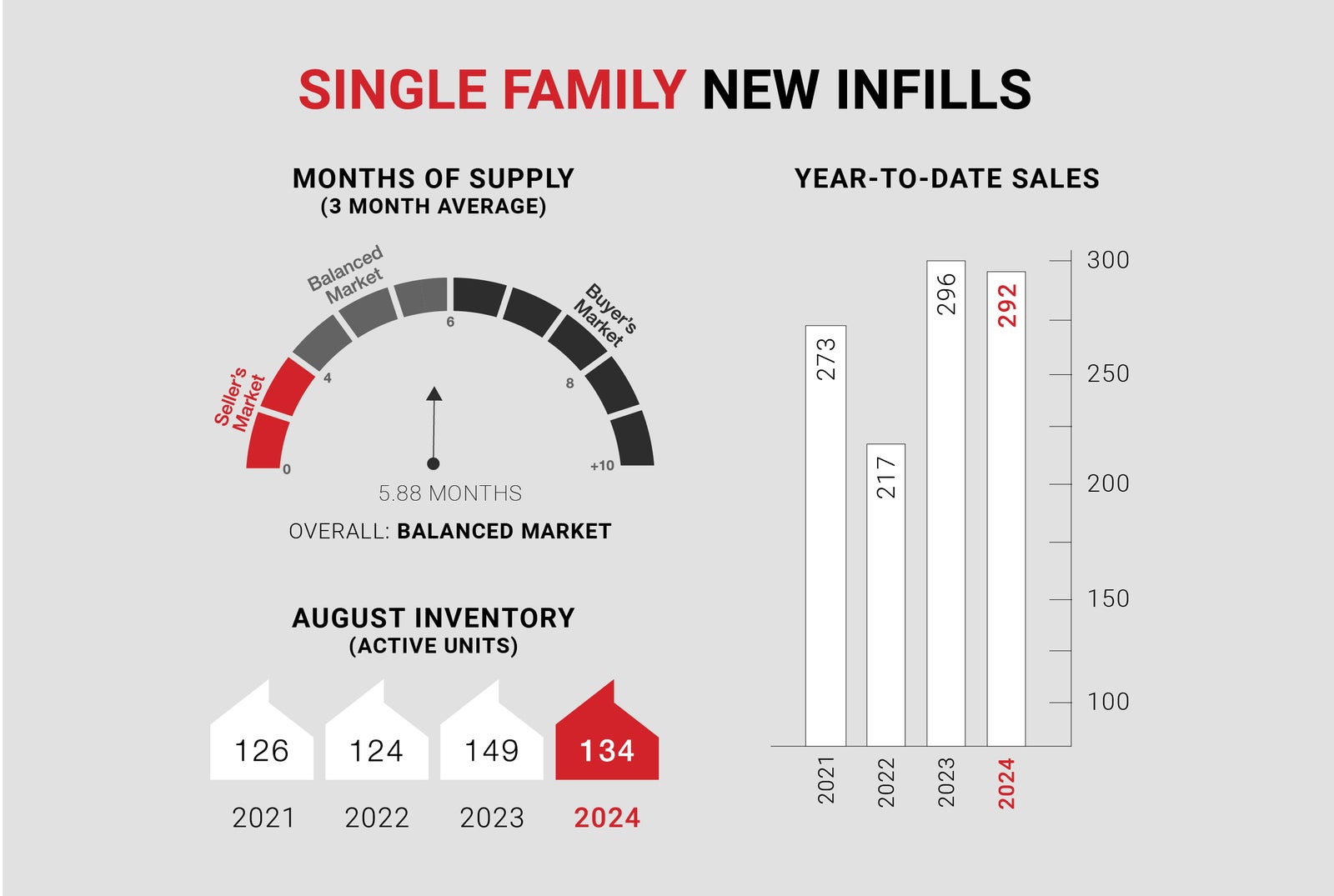

Single-family new infills posted 16 sales during the month of August, down considerably from the 26 sales recorded last month and also down from the 33 sales recorded in August of last year. Single-family new infill inventory has increased slightly to 134 active listings for sale, up from the 123 active listings recorded last month, but is still down from the 149 active listings recorded at this time last year.

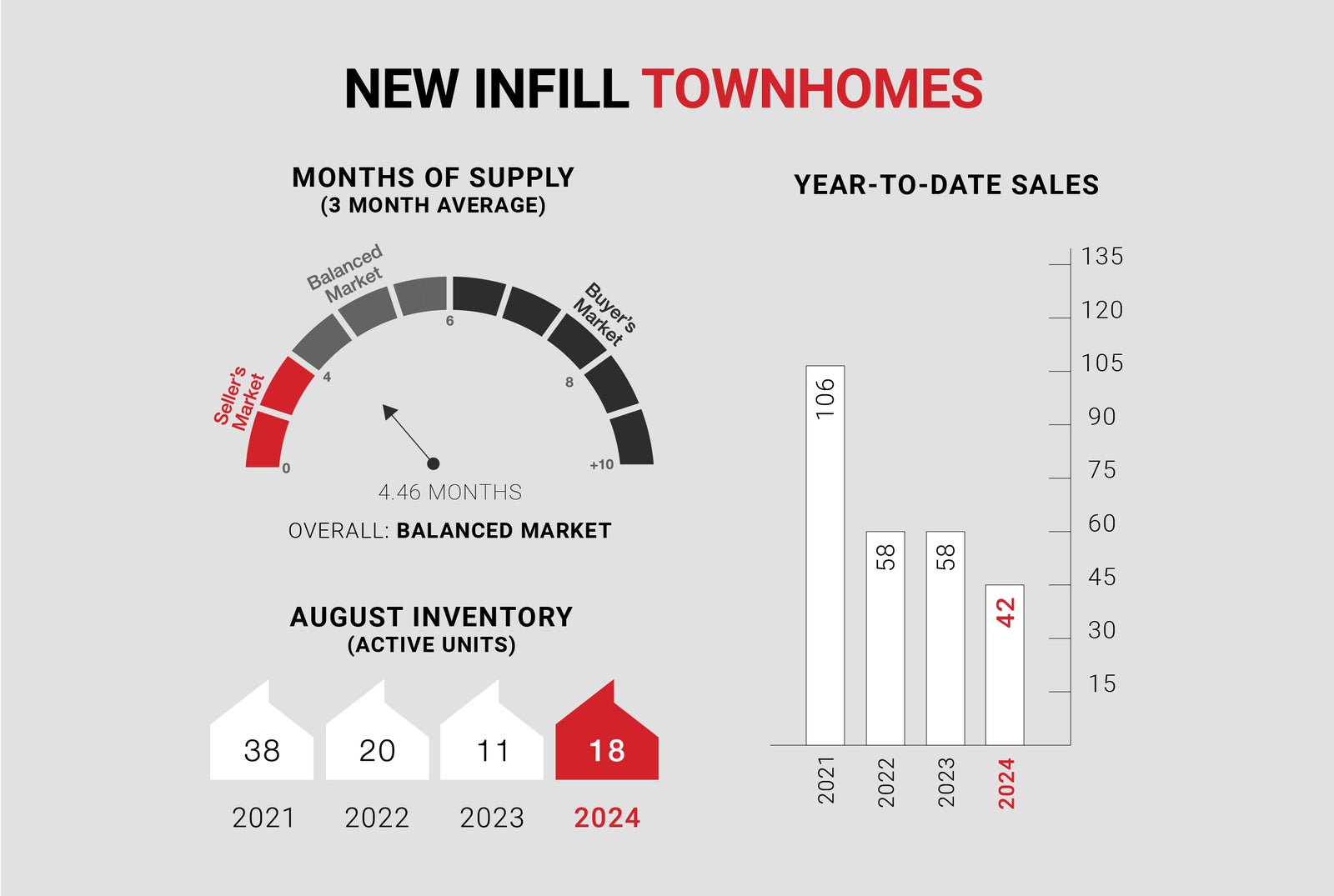

New infill townhomes posted 4 sales during the month of August, down from the 5 sales recorded last month and also down from 6 sales recorded in August of last year. New infill townhome inventory has increased slightly to 18 active units for sale, up from the 17 active units recorded last month and from the 17 active units recorded at this time last year.

Although sales activity typically strengthens through September as kids head back to school and buyers resume their searches without being distracted by the summer holidays, this fall may prove to be different. Sales activity throughout the entire Calgary market has been trending downwards since May, while inventory has been slowly accumulating. This pattern can often lead to Buyers waiting on the sidelines, hoping for prices to soften, further slowing the market. That said, interest rates have been slowly dropping over the past few months, and this trend is expected to continue through the Fall, which typically leads to increased buyer demand. These two factors combined are likely to keep the market steady rather than any significant softening.

Although the overall market seems to be levelling off from the intense seller market conditions seen through most of 2024 to date, we aren’t convinced that prices will decline by any meaningful amount through the rest of the year based on current inventory levels. More interesting to watch will be the impact of new zoning throughout Calgary, which has opened up many new inner-city communities to infill development. We may start to see more infill options in different areas coming to market in 2025 - potentially at more attractive prices due to lower land acquisition costs.

CALGARY MARKET UPDATE (CREB)

City of Calgary, September 3, 2024 - Housing activity continues to move away from the extreme sellers’ market conditions experienced throughout the spring. Easing sales, combined with gains in supply, pushed the months of supply above two months in August, a level not seen since the end of 2022.

“As expected, rising new home construction and gains in new listings are starting to support a better-supplied housing market,” said Ann-Marie Lurie, Chief Economist at CREB®. “This trend is expected to continue throughout the remainder of the year, but it’s important to note that supply levels remain low, especially for lower-priced properties. It will take time for supply levels to return to those that support more balanced conditions.”

Inventory levels in August reached 4,487 units, 37 percent higher than last August but nearly 25 percent lower than long-term trends for the month. Higher-priced properties mostly drove the supply gains, as the most affordable homes in each property type continued to report supply declines.

The supply gains were made possible by increased new listings in August and a pullback in sales activity. There were 2,186 sales in August, representing a 20 percent decline from last year's record high but still 17 percent higher than long-term averages for the month. The sales declines were driven by homes priced below $600,000.

Following stronger-than-expected gains earlier in the year, price growth is slowing. In August, the total unadjusted residential benchmark price was $601,800, six percent higher than last year and just slightly lower than last month. Year-to-date, the average benchmark price rose by nine percent.