New infill sales hold steady through the first half of Summer.

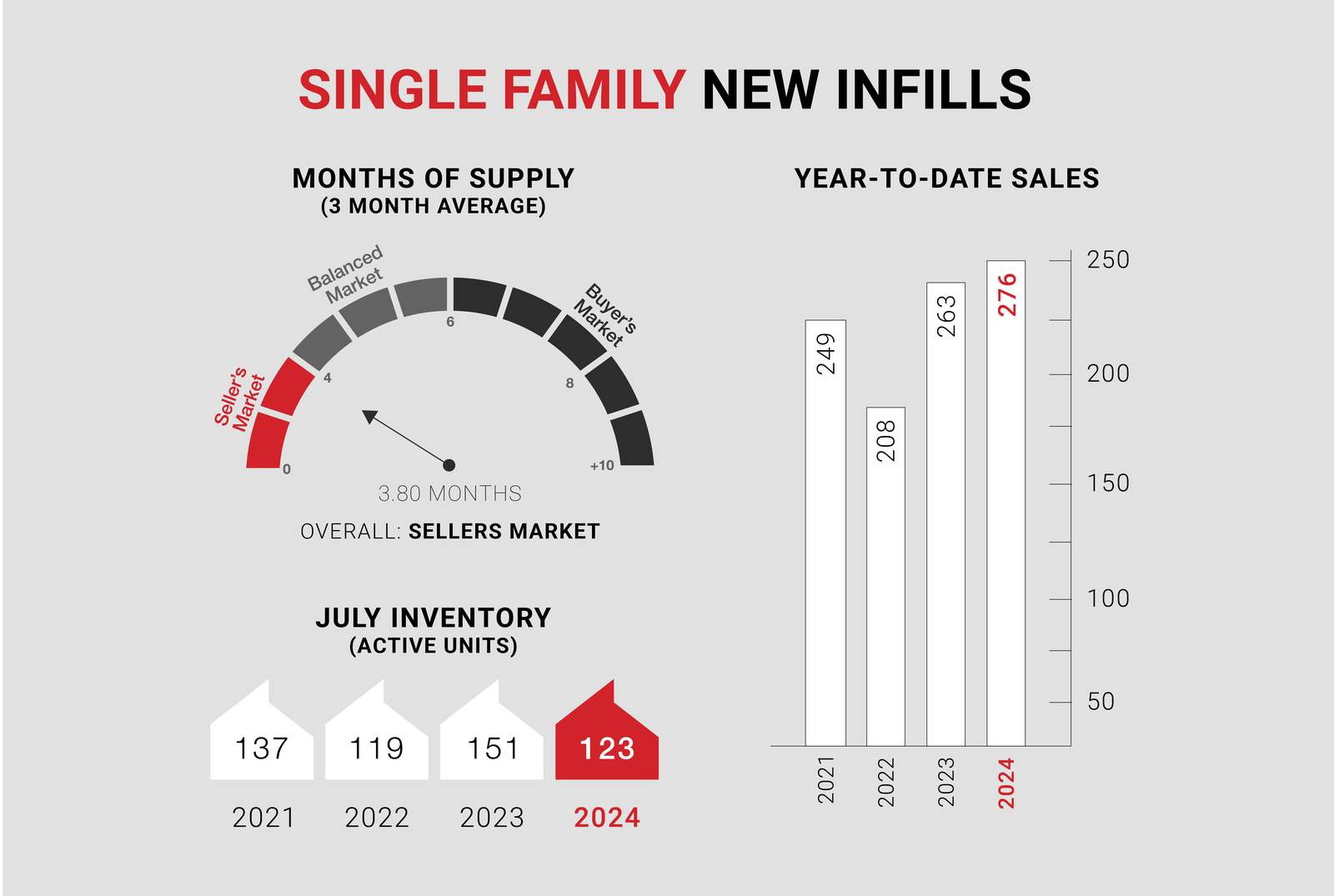

Single-family new infills posted 26 sales during the month of July, up slightly from the 23 sales recorded last month and nearly on par with the 25 sales recorded in July of last year.

Single-family new infill inventory has declined slightly, to 123 active listings for sale, from 125 active listings recorded last month but down more significantly from the 151 active listings recorded at this time last year.

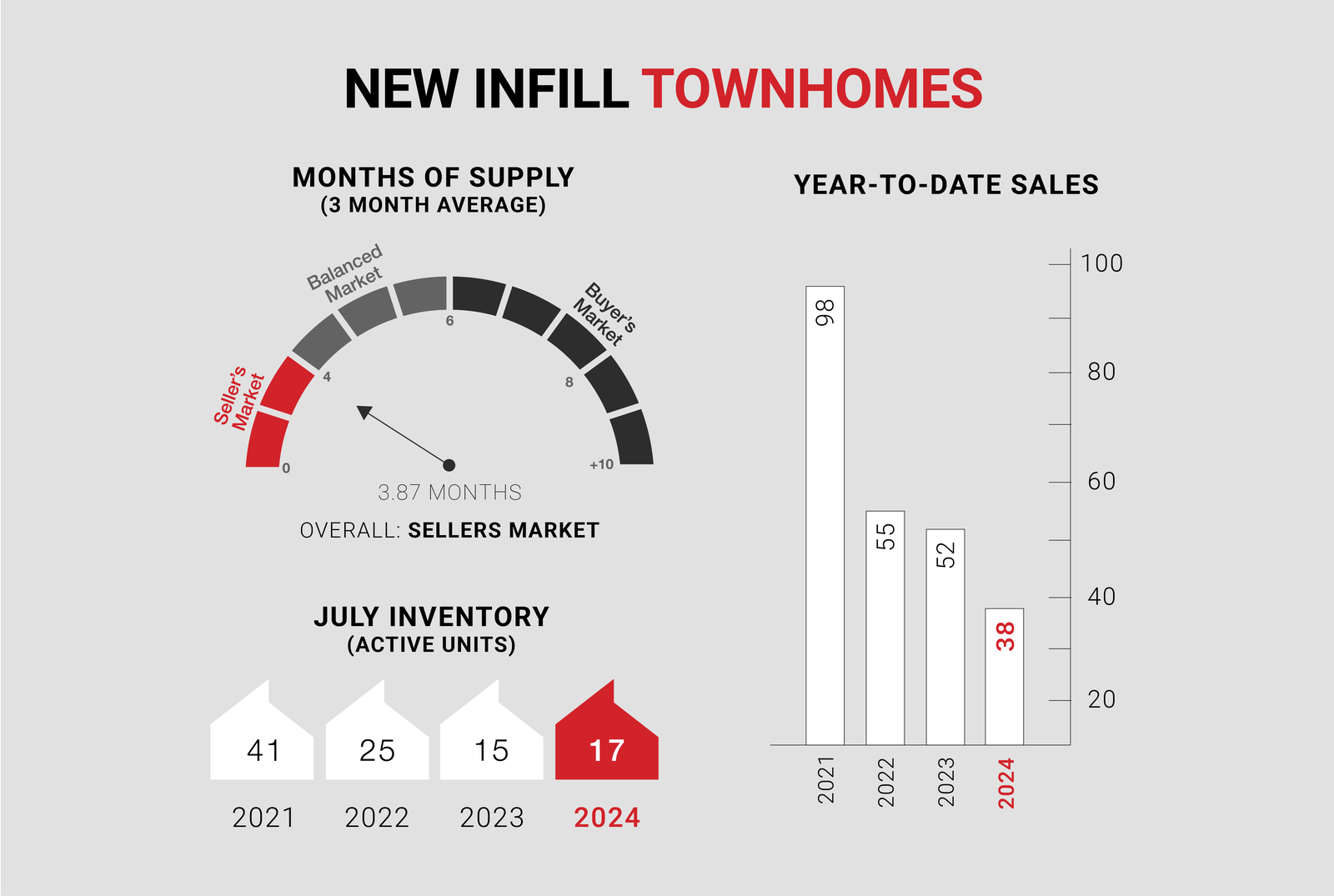

New infill townhomes posted 5 sales during the month of July, up from 4 sales recorded last month and down from 6 sales recorded in July of last year.

New infill townhome inventory has decreased to 17 active units for sale, down from 23 active units recorded last month, although slightly up from the 15 active units recorded at this time last year.

With Summer now halfway through, it seems that the new infill market is holding steady in both the single-family and Townhome sectors. With the approved city-wide rezoning coming into effect in the next few weeks, we expect to see a flurry of new DP applications heading into the city for review in the coming months. Over time, this could translate into more inventory coming to market at a variety of price points in the next 12 months across the city.

CALGARY MARKET UPDATE (CREB)

City of Calgary, August 1, 2024 - With the busy spring market behind us, we are starting to see some shifts in supply levels. With 2,380 sales and 3,604 new listings, the sales-to-new listings ratio fell to 66 percent, supporting a gain in inventory. Inventories rose to 4,158 units, still 33 percent below what we typically see in July, but the first time they have pushed above 4,000 units in nearly two years.

Although the majority of supply growth occurred for homes priced above $600,000, the rise has helped shift the market away from the extreme sellers’ market conditions experienced throughout the spring.

“While we are still dealing with supply challenges, especially for lower-priced homes, more options in both the new home and resale market have helped take some of the upward pressure off home prices this month,” said Ann-Marie Lurie, Chief Economist at CREB®. “This is in line with our expectations for the second half of the year, and should inventories continue to rise, we should start to see more balanced conditions and stability in home prices.”

July sales eased by 10 percent over last year's record high but were still higher than long-term trends for the month. Like last month, the pullback in sales has been driven by homes priced below $600,000.

Nonetheless, the gain in inventory combined with slower sales caused the months of supply to rise to 1.8 months, still low enough to favour the seller but a significant improvement from the under one month reported earlier this year.

Improved supply helped slow the pace of monthly price growth for each property type. In July, the total residential benchmark price was $606,700, similar to last month and nearly eight percent higher than last year's levels.