New infill sales see a significant decline as inventory levels begin to inch upward.

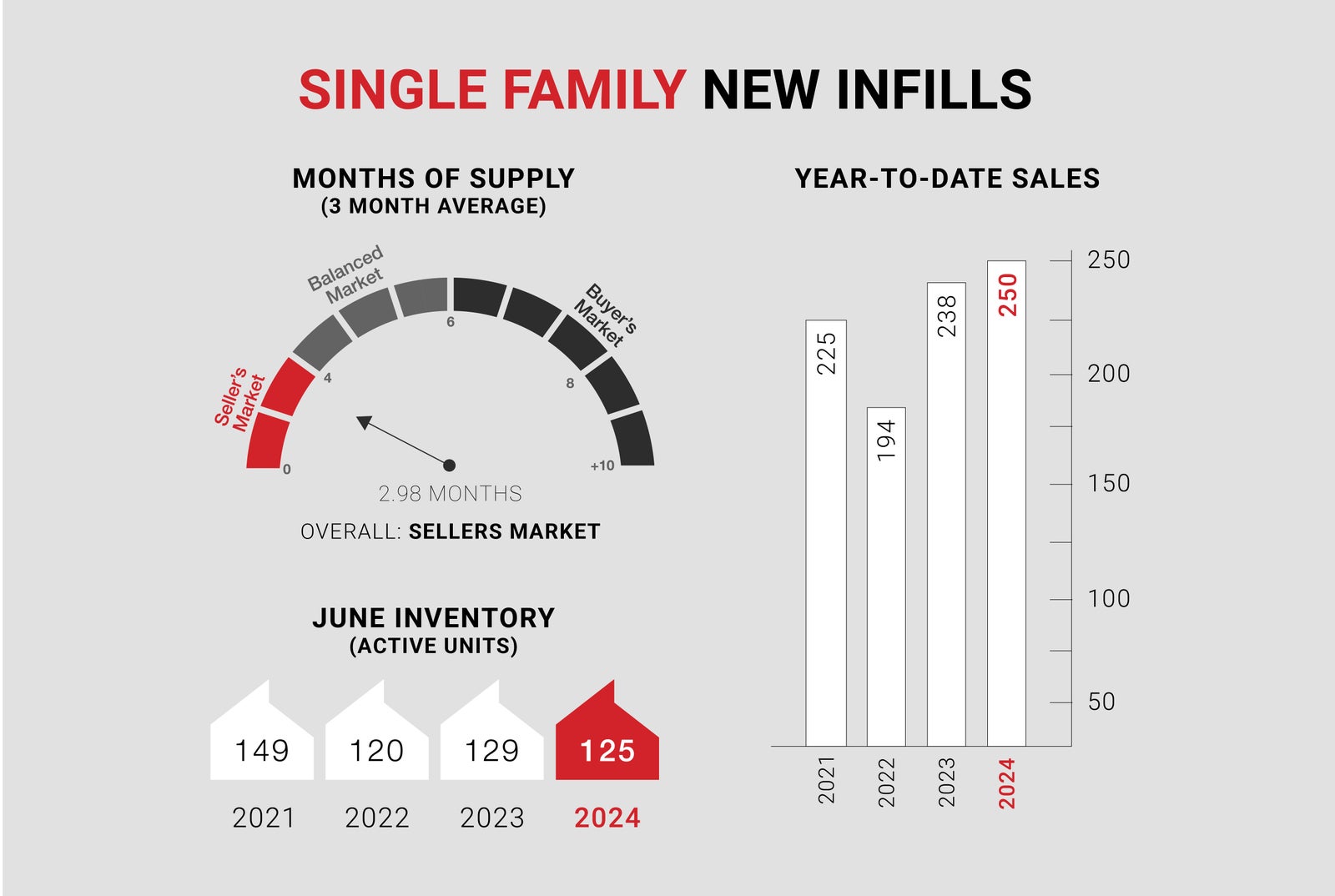

Single-family new infills posted only 23 sales during the month of June, down from 47 sales recorded last month and down from 35 sales recorded in June of last year.

The single-family new infill inventory has increased slightly to 125 active listings for sale from 117 active listings recorded last month, which is down from 129 active listings recorded at this time last year.

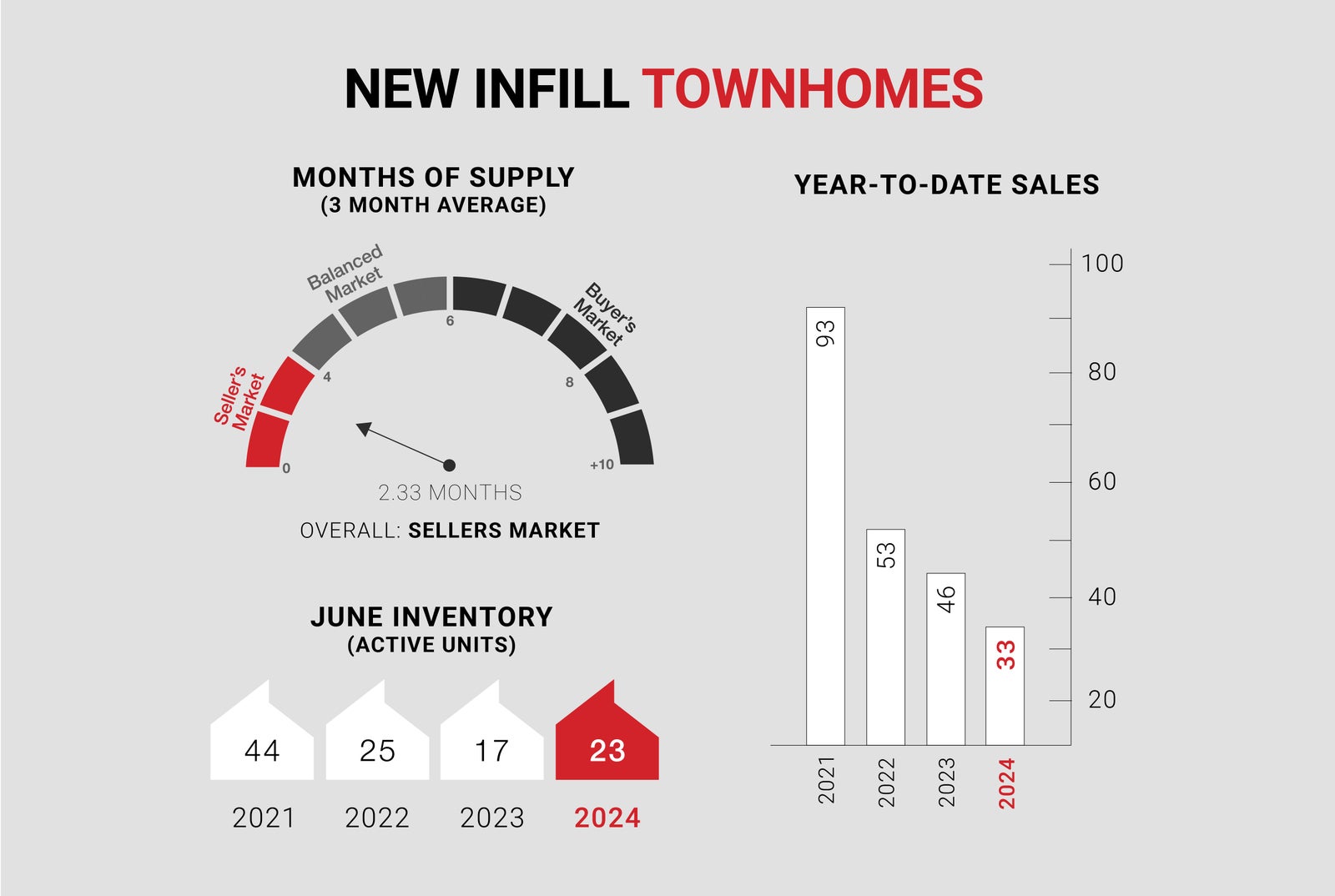

New infill townhomes posted only 4 sales during the month of June, down from 6 sales recorded last month and on par with the 4 sales recorded in June of last year.

New infill townhome inventory has increased modestly, to 23 active units for sale, from 18 active units recorded last month and is also up from 17 active units recorded at this time last year.

With kids out of school and summer upon us, attention seems to be shifting away from real estate.

We expect July activity to be unremarkable for new infill sales, given Stampede and other summer vacation plans, which will give Calgary a much-needed breather in the real sector.

CALGARY MARKET UPDATE (CREB)

City of Calgary, July 2, 2024 - Sales in June reached 2,738, a 13 percent decline from last year’s record high. Although sales improved for homes priced above $700,000, it was not enough to offset the declines reported in the lower price ranges. Despite the easing in June sales, they remain over 17 percent higher than long-term trends.

“The pullback in sales reflects supply challenges in the lower price ranges, ultimately limiting sales activity,” said Ann-Marie Lurie, Chief Economist at CREB®. “Inventory in the lower price ranges of each property type continues to fall, providing limited choices for potential purchasers looking for more affordable products. It also continues to be a competitive market for some buyers with over 40 percent of the homes sold selling over list price.”

This month, new listings also eased relative to sales, causing the sales-to-new-listings ratio to remain elevated at 72 percent. Inventory levels did improve over last year’s low levels, primarily due to gains in the higher price ranges. However, with 3,789 units available, levels remain 40 percent lower than long-term trends.

The modest change in inventory levels helped increase the months of supply. However, at 1.4 months, conditions continue to favour sellers. Persistently tight conditions drove further price gains this month. In June, the unadjusted benchmark price rose to $608,000, a gain over last month and nearly nine percent higher than last year. Prices rose across all districts, with the most significant year-over-year gains occurring in the North East and East districts.