Sales activity in the new infill sector remains steady as inventory levels decline and prices inch upwards.

Single-family new infills posted 51 sales during the month of April, down from 55 sales recorded last month and up from 42 sales recorded in April of last year.

Single-family new infill inventory has declined, to 118 active listings for sale, from 124 active listings recorded last month and 152 active listings recorded at this time last year.

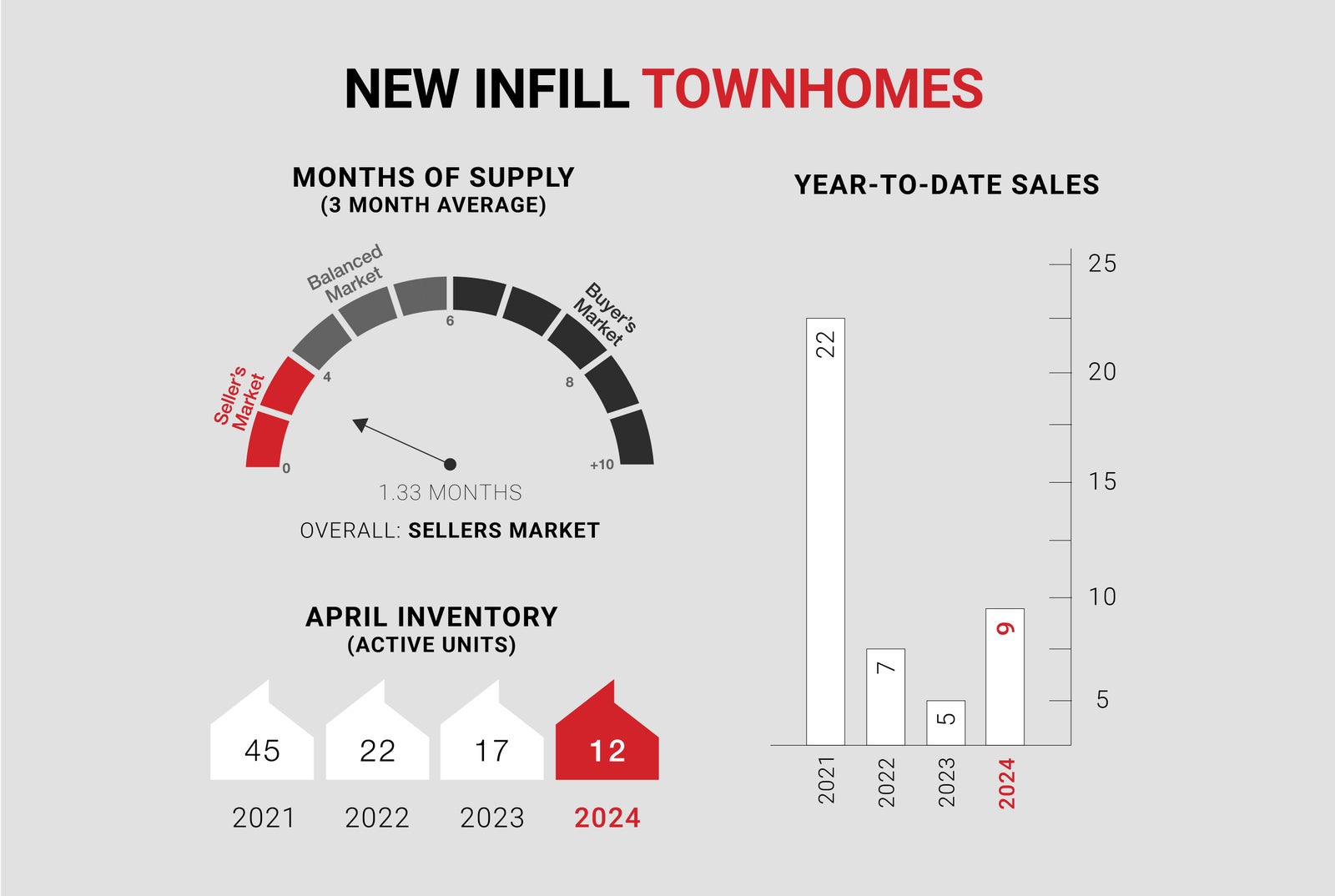

New infill townhomes posted 9 sales during the month of April, up slightly from the 7 sales recorded last month, and up considerably from the 5 sales recorded in April of last year.

New infill townhome inventory has declined slightly, with 12 active units for sale, down from 17 active units recorded at this time last year.

With continued strong demand and limited inventories in the single-family and townhouse markets, both segments are now firmly in seller market territory.

As the development community and the entire city patiently await the decision on the proposed blanket re-zone, inner-city land prices surge. Irrespective of the decision made at city hall, it will be interesting to see how the pace and type of future real estate development will change given the continuous upward pressure on input costs.

CALGARY MARKET UPDATE (CREB)

City of Calgary, May 1, 2024 - Sales in April rose by seven percent compared to last year, to 2,881 units. While the pace of growth did ease compared to earlier in the year, sales remain 37 percent higher than long-term trends for the month. Much of the growth in sales has occurred for relatively more affordable, higher-density products.

At the same time, there were 3,491 new listings in April, an 11 percent gain over last year but only three percent higher than long-term trends. The rise in new listings compared to sales prevented any further deterioration of the inventory situation. However, with 2,711 units in inventory, levels are 16 percent below last year and half of what is traditionally seen in April.

“While supply levels are still declining, much of the decline has been driven by lower-priced homes," said Ann-Marie Lurie, Chief Economist at CREB®. “Homes priced below $500,000 have reported a 29 percent decline. Meanwhile, we are seeing supply growth in homes priced above $700,000. Persistently high-interest rates are driving demand toward more affordable products in the market and, at the same time, driving listing growth for higher-priced properties.”

With a sales-to-new-listings ratio of 83 percent and a months of supply of less than one month, conditions continue to favour the seller, driving further price gains in the market. In April, the unadjusted total residential benchmark price reached $603,700, a one percent gain over last month and nearly 10 percent higher than last year's levels. Price gains occurred across all property types and districts of the city. The strongest price growth occurred in the more affordable districts of the city.