New infills post better than expected sales performance in March despite low inventory levels in all segments of the market.

Single-family new infills posted 55 sales during the month of March, up considerably from the 43 sales recorded last month and very similar to the 54 sales recorded in March of last year.

Single-family new infill inventory has declined, to 124 active listings for sale, from 130 active listings recorded last month and 159 active listings recorded at this time last year.

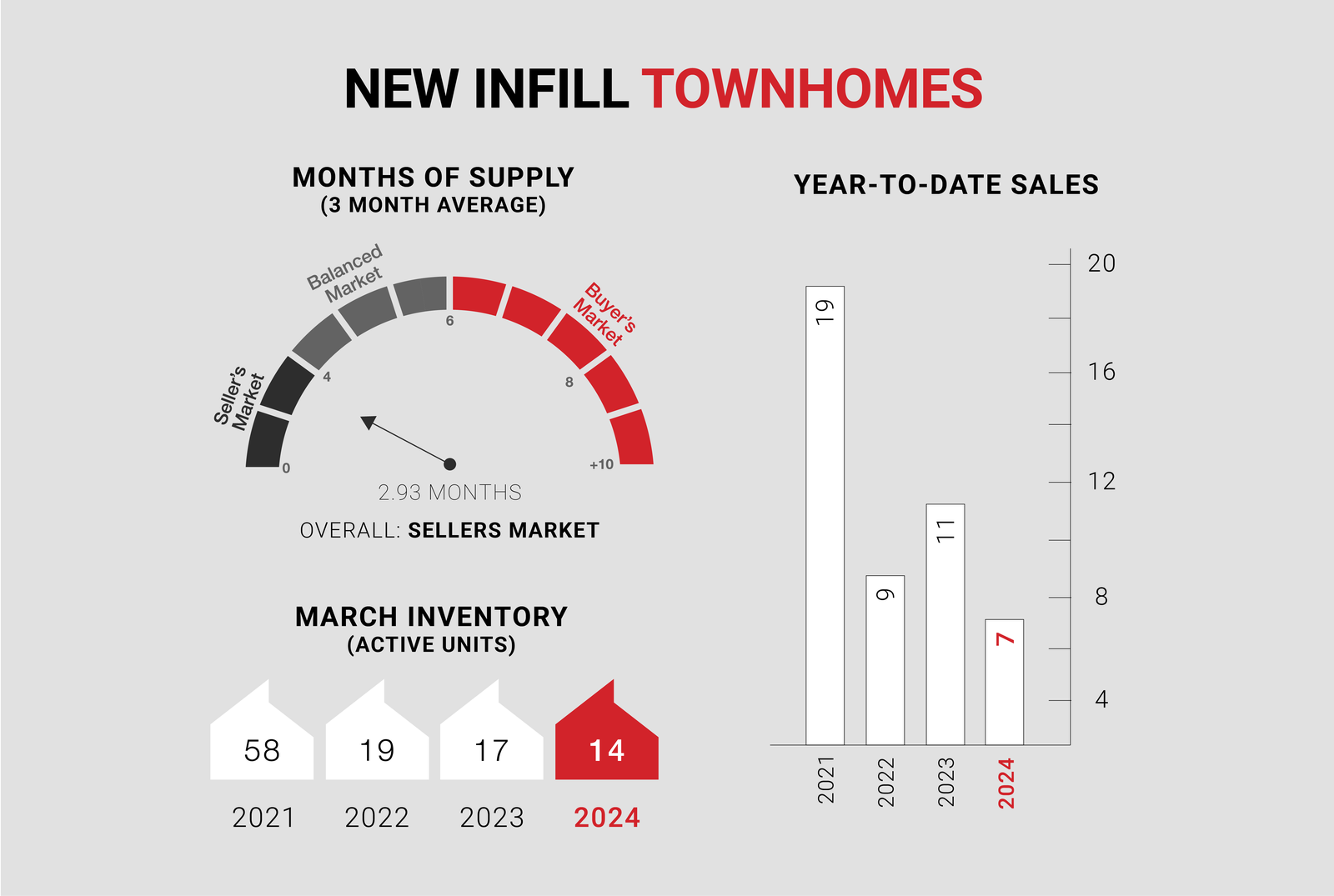

New infill townhomes posted 7 sales during the month of March, up slightly from the 6 sales recorded last month, and down from the 11 sales recorded in March of last year.

New infill townhome inventory has remained unchanged with 14 active units for sale and is down from 17 active units recorded at this time last year.

As the Spring selling season unfolds, new infills are expected to continue to perform well over the coming months with limitations mostly being related to low inventory levels.

CALGARY MARKET UPDATE (CREB)

City of Calgary, April 1, 2024 - March sales rose to 2,664 units, a 10 percent year-over-year gain and much higher than long-term trends. While new listings did pick up over last month, the 3,172 units were still below what we typically see in March and not enough relative to sales to drive any change in the supply situation. In March, the sales-to-new listings ratio rose to 84 percent, and the months of supply fell below one month.

“We have not seen March conditions this tight since 2006, which is also the last time we reported high levels of interprovincial migration and a months-of-supply below one month," said Ann-Marie Lurie, Chief Economist at CREB®. “Moreover, we are entering the third consecutive year of a market favouring the seller as the two-year spike in migration has driven up demand and contributed to the drop in re-sale and rental supply. Given supply adjustments take time, it is not a surprise that we continue to see upward pressure on home prices.”

Inventory levels have declined across properties priced below $1,000,000, with the steepest declines occurring for homes priced below $500,000. In March, there were 2,532 units in inventory, 22 percent lower than last year and half the levels we traditionally see in March.

In March, the unadjusted total residential benchmark price rose to $597,600, a two percent gain over last month and nearly 11 percent higher than last year. Prices have increased across all property types, with the most significant year-over-year gains occurring for the relatively more affordable row and apartment-style homes.