The Calgary Real Estate Board (CREB) recently put out their annual market and economic review and forecast. This annual report examines the housing sector, local Calgary economy, and other variables which impact real estate such as lending rates and migration patterns.

Here, a look at what CREB has to say about the Calgary economy. If you are looking for insights into the Calgary real estate market, visit our sister post: CREB 2023 MARKET SUMMARY & 2024 FORECAST

Here, a look at what CREB has to say about the Calgary economy. If you are looking for insights into the Calgary real estate market, visit our sister post: CREB 2023 MARKET SUMMARY & 2024 FORECAST

ECONOMIC SUMMARY

The Canadian economy has been affected by higher interest rates and inflationary pressures, leading to a slowdown in consumer spending and business activity in the latter part of 2023. This trend is anticipated to persist into 2024. High lending rates and inflation are expected to impact consumers in Alberta. However, economic growth is expected to outperform most other provinces primarily due to the recent gains in the energy sector and population growth.

Alberta’s relatively strong growth is also being supported by gains in other industries, including technology, aviation, hydrogen, carbon capture and storage and renewables.

LENDING RATES & INFLATION

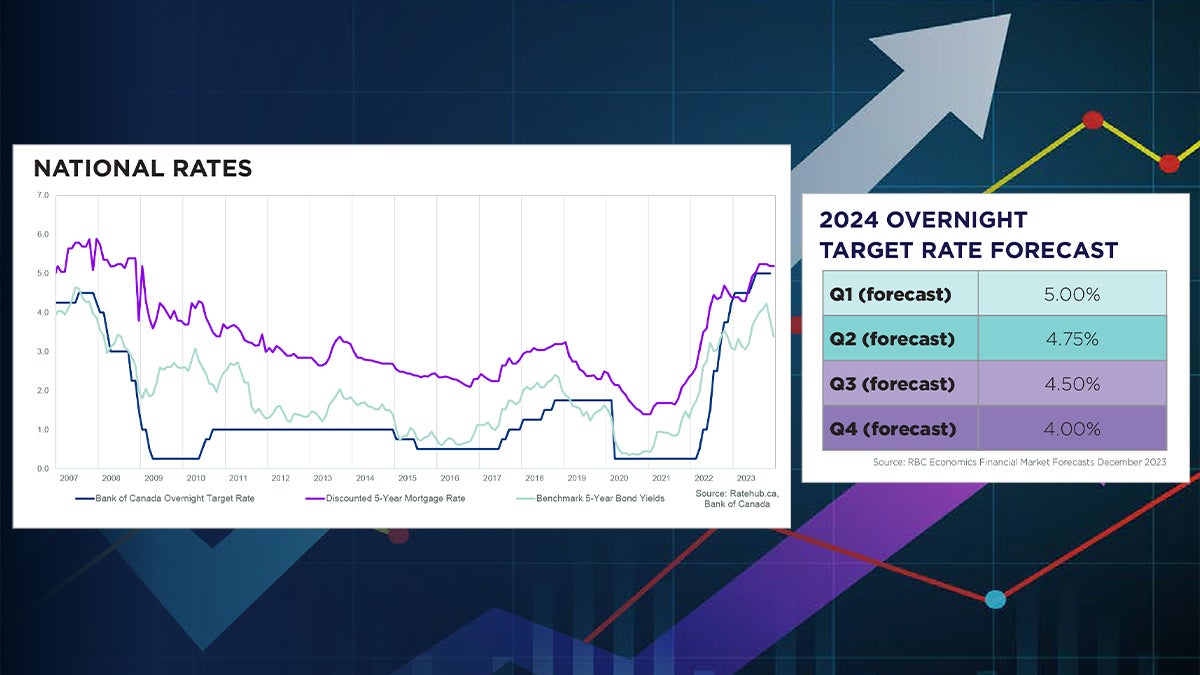

Persistent inflation prompted the Bank of Canada to implement further rate hikes in the second half of 2023, bringing the overnight target rate to five percent. This resulted in a significant increase in bond yields and five-year rates towards the end of the year, impacting both broader economic activity and the housing market.

The elevated rates successfully reduced inflation to three percent by the close of 2023. Although inflation remains above target levels, many analysts and forecasters believe the current rates are overly restrictive. As a result, there’s an expectation that the Bank of Canada might initiate a reduction in lending rates in the latter part of the year. While rates are anticipated to decrease to four percent by the end of 2024, they will still be considerably higher than pre-pandemic levels.

Source: Ratehub.ca, Bank of Canada & RBC Economics Financial Market Forecasts December 2023

POPULATION

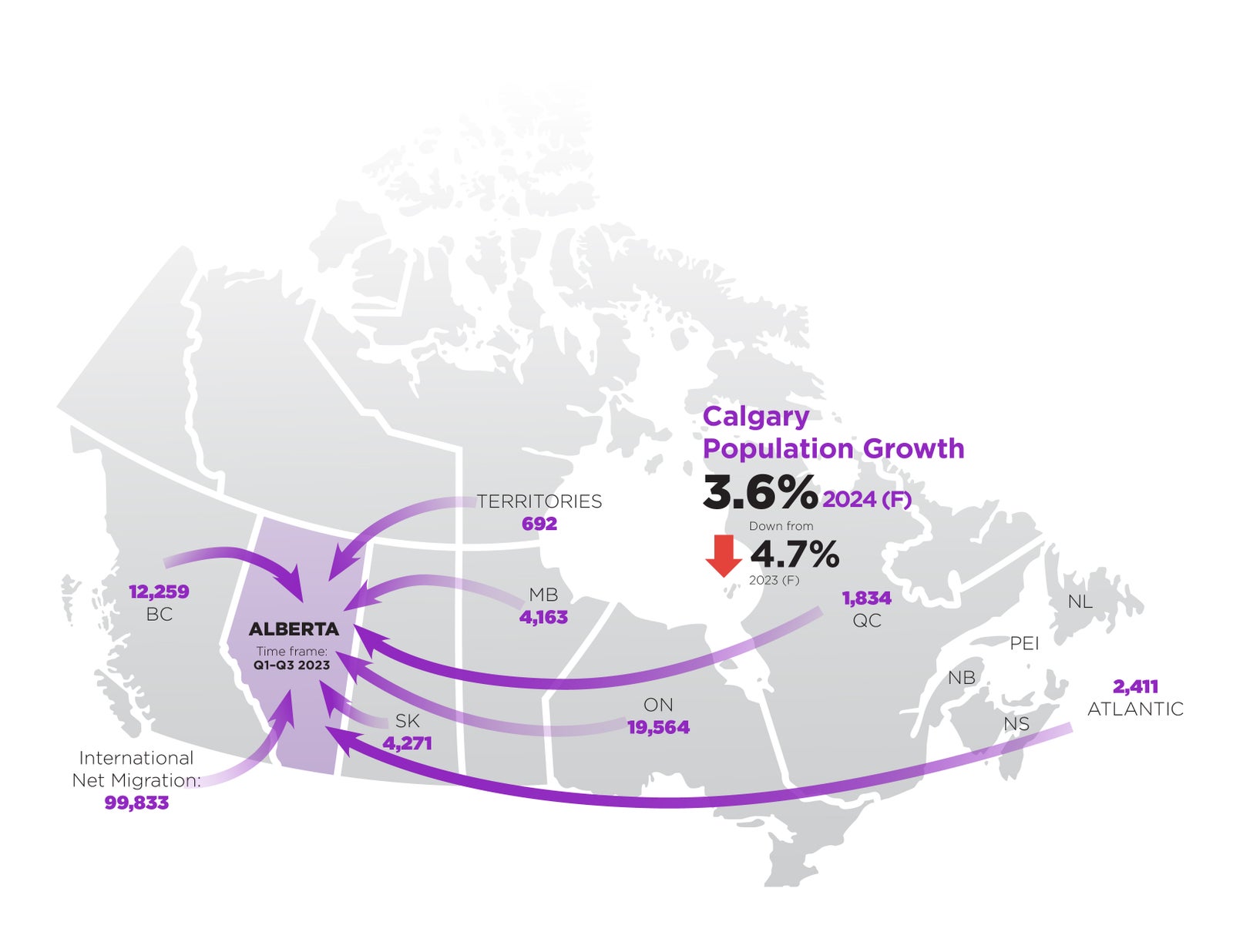

The recent shift in international and interprovincial migration is the primary driver of the tightening seen in the housing market over the past several years. For five consecutive quarters, migration levels have surpassed 30,000 migrants per quarter, with Q3 2023 reporting an all-new record high of 56,306 migrants. While Alberta has never experienced this level of international migration, we are also seeing a surge in interprovincial migration. Alberta welcomed 45,194 interprovincial migrants from Q1 – Q3 2023, just shy of the annual record high in 2006 of 46,239.

While interprovincial migration is expected to slow into 2024, gains in both interprovincial and international migration throughout 2022 – 2023 are expected to continue supporting higher housing demand levels into 2024. On an annual basis, population growth in the province is expected to be near four percent in 2023 and remain at a similar pace of growth in 2024.

Recent estimates from Statistics Canada show that Calgary is accounting for nearly half of the population growth in the province and is seeing its population grow faster than the provincial total. Forecasters expect that in 2023, Calgary’s population will grow by nearly five percent, slowing to a four percent growth rate in 2024. Despite the slower growth expected, population growth remains high and should continue to fuel strong housing demand throughout 2024.

Sources: Statistics Canada & Conference Board of Canada Forecast

EMPLOYMENT UPDATE

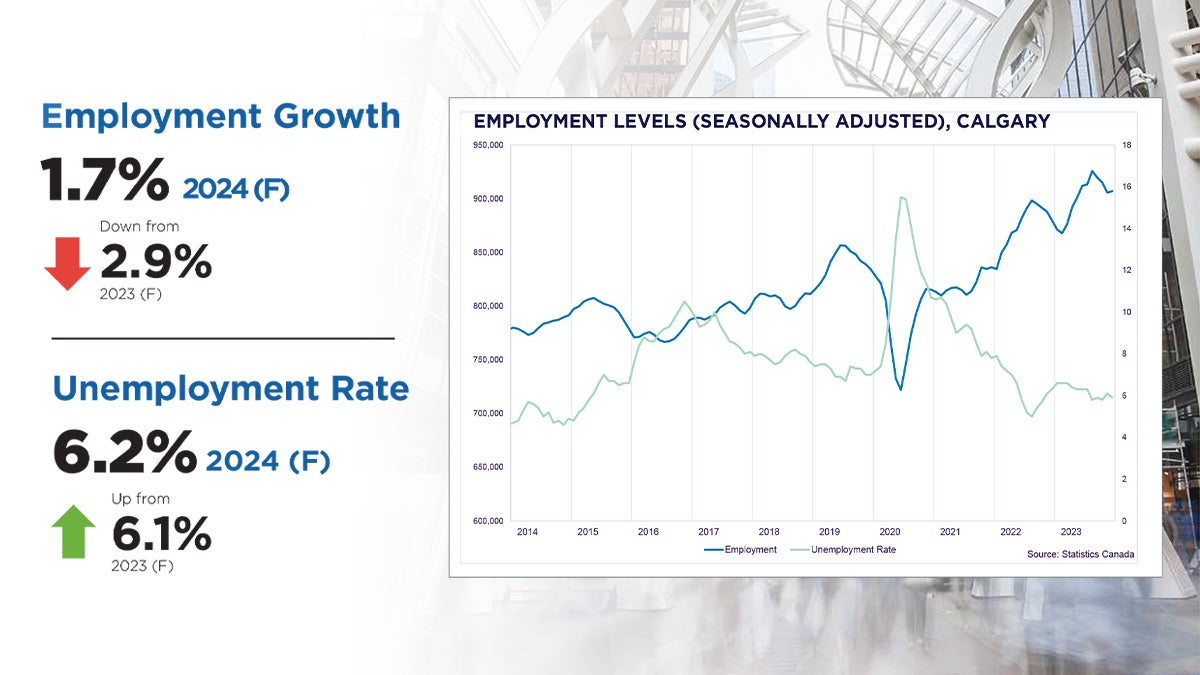

Calgary has benefited from robust employment growth over the past several years, with the professional, scientific, and technical services sector being the primary contributor in 2023. The employment sector’s sustained growth is expected to continue supporting housing activity into 2024. Although the rate of employment growth has decelerated in 2023 and is anticipated to slow further in 2024, there is no substantial forecasted increase in unemployment or job loss. This outlook supports the expectation of continued stability in housing activity throughout 2024.

Source: Conference Board of Canada

HOUSING SUPPLY

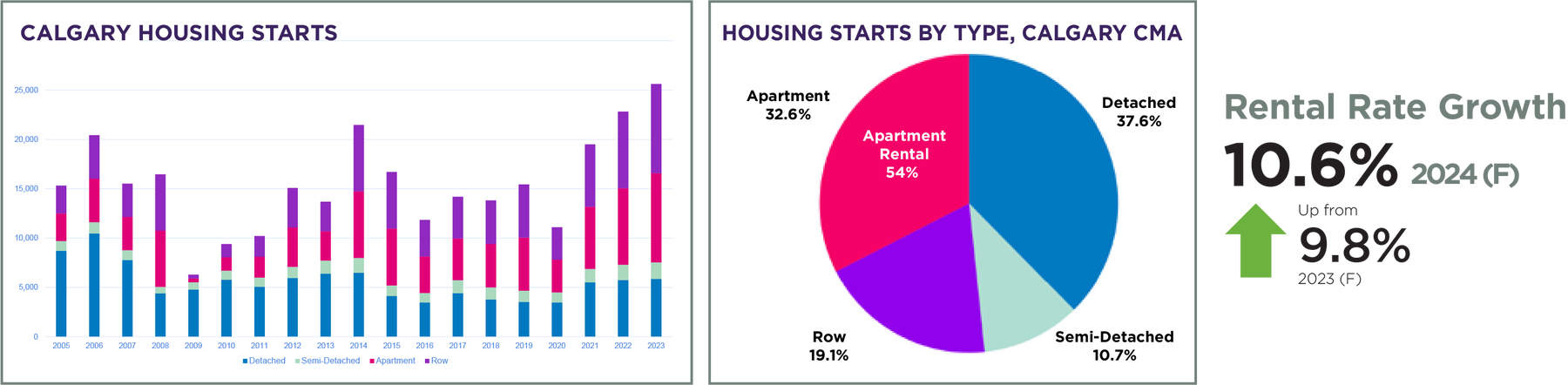

The sudden and sharp rise in international migration has played a significant role in driving up demand for rental properties. This surge in rental demand has led to a decrease in supply and substantial increases in rental rates since 2022. The heightened rents have also spurred demand in the resale market, as both renters and investors actively pursued available resale properties.

Limited supply choice in the resale and rental markets supported stronger home start activity in 2023. In the Calgary census metropolitan area, 2023 housing starts are on pace to hit record levels. Most starts have been in the apartment sector, with over half of the units targeted toward purpose-built rental.

Gains in new home starts for rental and ownership will help provide more choice in the market, helping shift the resale market away from the extreme seller’s market conditions we have faced over the past year. However, the supply growth will take time and is contingent on the migration flow into the city and the development process.

Source: CMHC & Statistics Canada

How is Calgary Different?

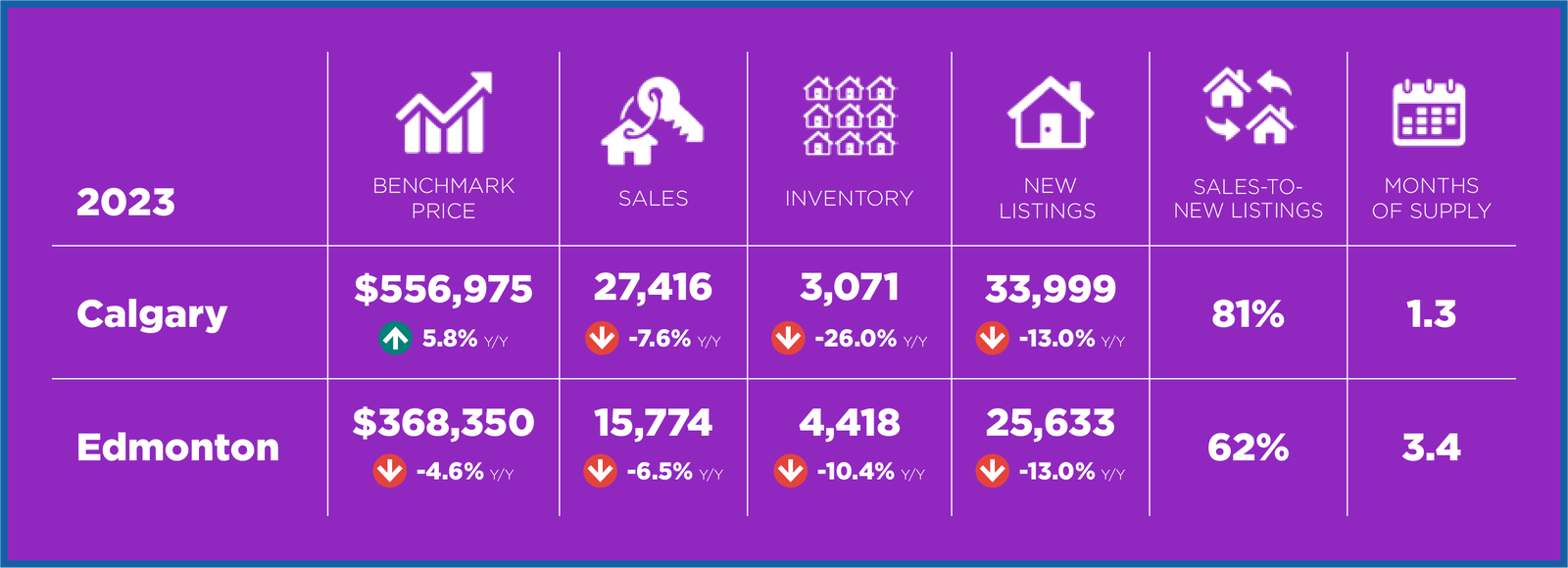

CALGARY VS. EDMONTON COMPARISON

While Alberta has experienced significant population growth due to international and interprovincial migration, the housing dynamics in the province’s two largest cities have differed. Calgary is perceived to be drawing a larger share of interprovincial migration, supporting some of the sales growth in the higher-priced market segments while simultaneously exerting pressure on supply. The limited supply relative to demand in Calgary played a role in the annual benchmark price gain of nearly six percent. However, Edmonton prices are forecast to rise this year, as recent shifts to tighter market conditions will persist, given expected gains in employment and migration.

In contrast, Edmonton began the year with higher supply levels that persisted throughout the spring market, preventing home prices from rebounding. On an annual basis, Edmonton saw a nearly five percent decline in the benchmark price in 2023.

As we enter 2024, conditions remain tighter in Calgary compared to Edmonton. Despite recent shifts in the Edmonton market, the expectation is that price growth in Calgary will still outpace growth in Edmonton in 2024.

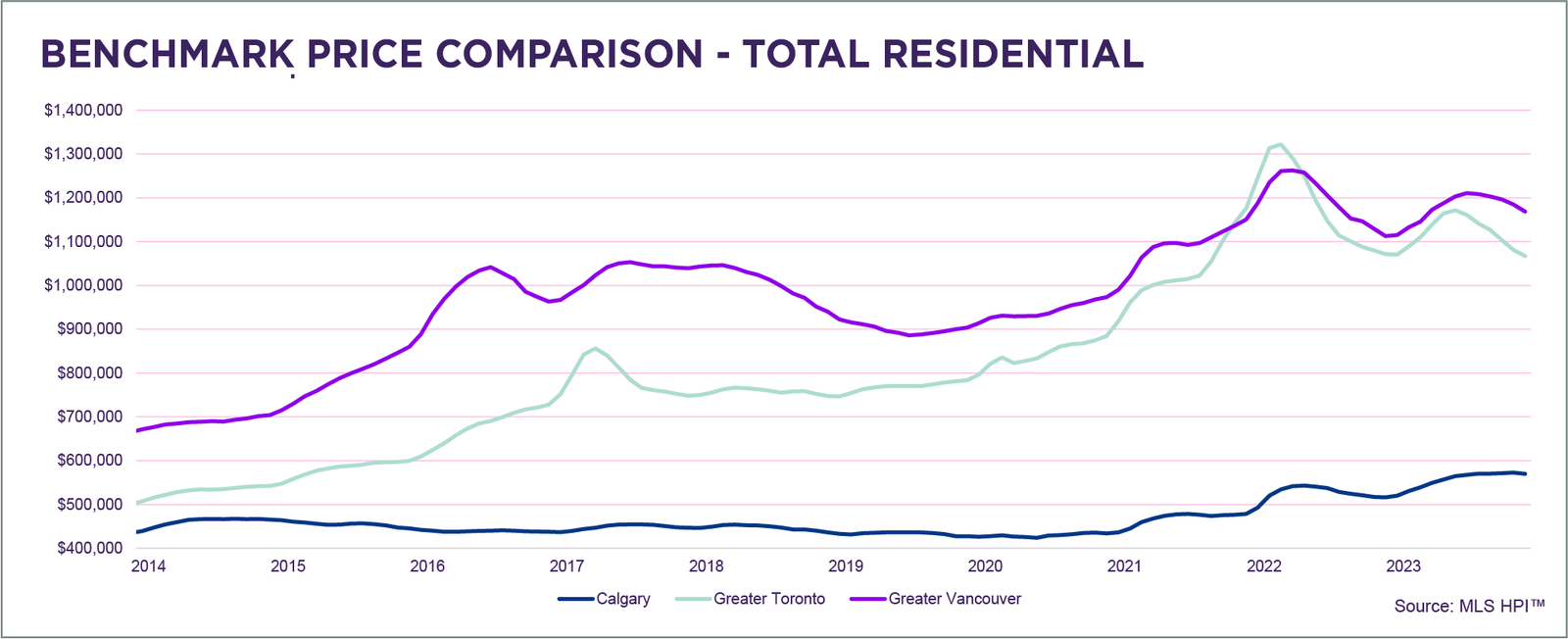

RELATIVE AFFORDABILITY

The housing market conditions vary across the country. Recent reports highlight a trend of easing prices in markets such as Toronto and Vancouver, signalling a shift in favour of the buyer. Conversely, in Calgary, home prices have been on the rise as conditions persistently favour the seller. Despite these recent gains, our market remains relatively affordable compared to the country’s two largest markets.

Source: MLS HPI™