New infills performed well in 2023 despite significant headwinds from rising interest rates and historically low inventory levels.

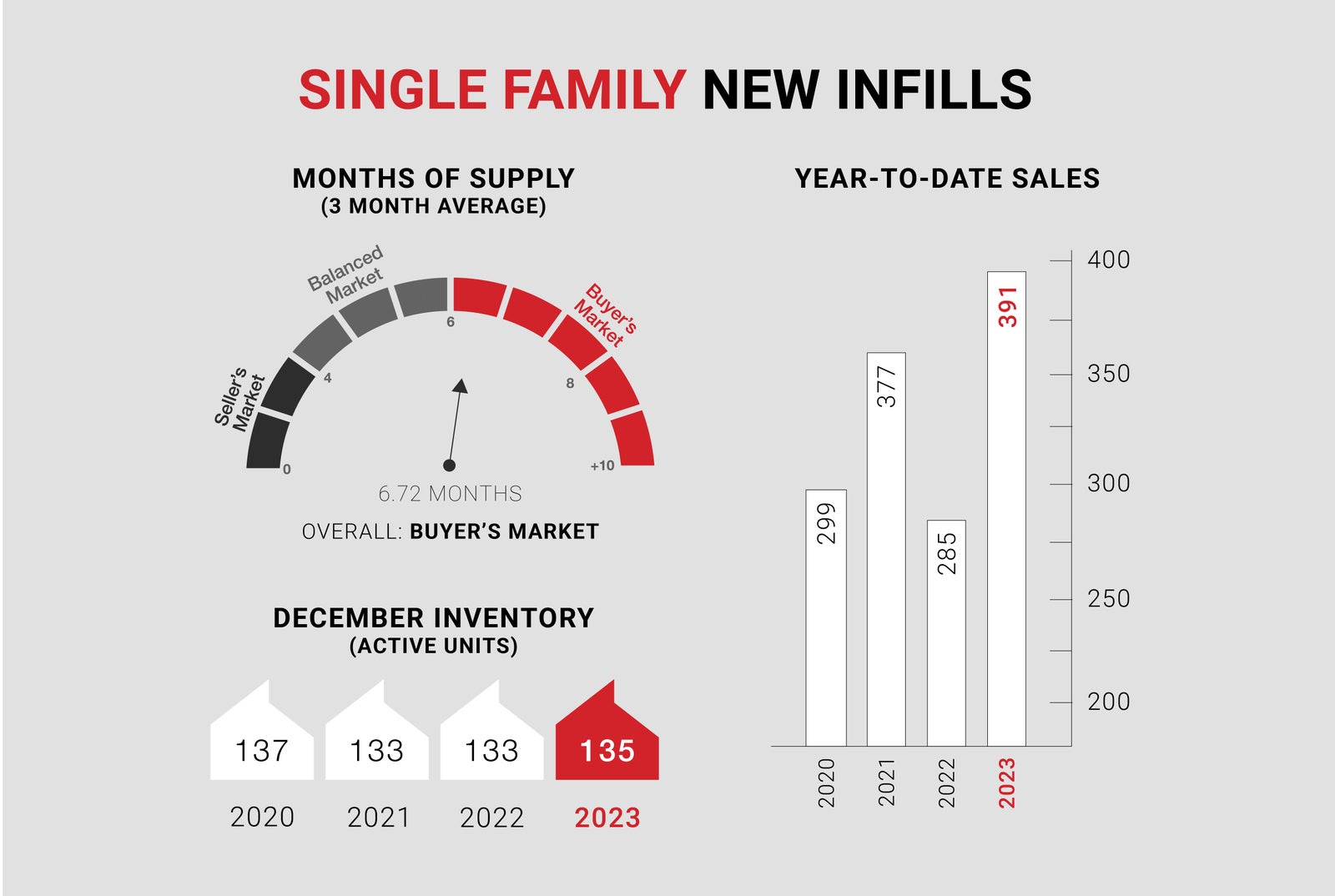

Single-family new infills posted 19 sales during the month of December, slightly down from the 20 sales recorded last month but up from the 14 sales recorded in December of last year. 2023 finished strong with 391 single-family new infill sales, up over 37% compared to 2022.

As expected at this time of the year, single-family new infill listings declined substantially to 135 active listings from 173 active listings recorded last month. Inventory was similar to this time last year, with 133 active single-family new infill homes for sale.

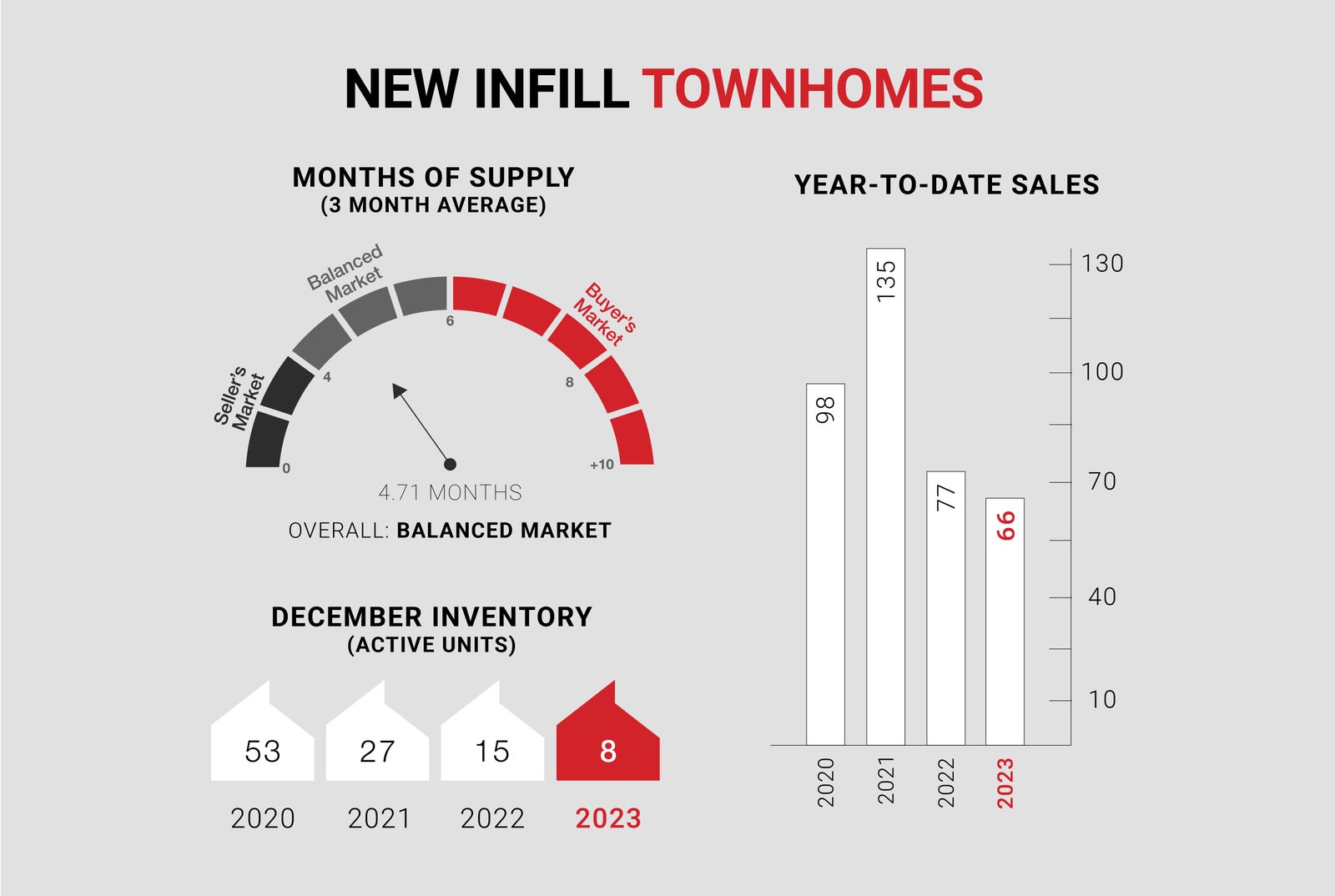

New infill townhomes posted no sales during the month of December, whereas 3 sales were recorded last month, and 7 sales were recorded in December of last year. Despite severely low inventory levels throughout the year, new infill townhomes had a surprisingly decent year, with 66 sales on record.

New infill townhome inventory has hit its lowest level on record, with only 8 active units for sale, down from 12 units recorded last month and 15 units recorded at this time last year. The average monthly inventory in 2023 was a staggeringly low 14 units for sale. By comparison, our peak average monthly inventory was in 2016, with 85 units for sale.

Sales activity is expected to be moderate throughout the first quarter of 2024, with a strong potential for an increase in demand should interest rates begin to come down in the second quarter of the year. Inventory levels throughout the entire market are expected to remain constrained throughout 2024 as population growth continues to outpace new housing starts.

From all of us at URBAN UPGRADE & NEWINFILLS, Happy New Year!

CALGARY MARKET UPDATE (CREB)

City of Calgary, Jan 2, 2024 - Sales in 2023 did ease relative to last year's peak, but with 27,416 sales, levels were still far higher than long-term trends and activity reported before the pandemic. While sales stayed relatively strong, there was a notable shift in activity toward more affordable apartment condominium-style homes.

“Higher lending rates dampened housing demand this year, but thanks to strong migration levels, housing demand remained relatively strong, especially for affordable options in our market,” said CREB® Chief Economist Ann-Marie Lurie. “At the same time, supply levels were low compared to the demand throughout the year, resulting in stronger than expected price growth.”

Inventory levels were persistently below long-term trends for the city throughout most of the year, averaging a 44 percent decline over the 10-year average. We also saw the months of supply remain well below two months throughout most of the year across homes priced below $1,000,000.

The persistently tight conditions contributed to our city's new record high price. While the average annual benchmark price growth did slow from 12 percent in 2022 to nearly six percent growth in 2023, the price growth was still relatively strong, especially compared to some markets in the country.