CREB, August 2023 - The Calgary Real Estate Board (CREB®) has released its Q2 2023 Housing Market Report. The report highlights a dynamic real estate landscape in the City of Calgary, showcasing strong trends in sales, demand and pricing. As expected, sales activity has slowed from last year’s record-breaking pace while staying stronger than long-term trends. What was not expected was the robust demand in the higher price segments of the market despite higher lending rates.

“An influx of migrants coming from Ontario and British Columbia are likely contributing to some of the strength for higher priced properties, as the relative affordability could make migrants less sensitive to the recent gains in lending rates, said CREB® Chief Economist Ann-Marie Lurie. At the same time, continued strength in our labour market is supporting demand across all property types.”

However, the robust demand is met with a shortage in supply. Housing inventory levels have remained notably low across various segments, encompassing the resale, new home, and rental markets. Despite relatively strong new home starts, these have not been sufficient to alleviate inventory constraints, primarily due to the influx of migrants. Resale supply has also encountered unexpected challenges, as higher lending rates and limited choices in supply have deterred existing homeowners from making changes.

The prevailing shortage in supply has contributed to the continuation of tight market conditions, which has led to stronger-than-expected price growth across all property types in the city. This steady appreciation in prices throughout the year has effectively offset declines observed in the latter half of 2022, ultimately resulting in new record-high prices.

“Home prices have exceeded our expectations as supply challenges have persisted throughout the spring market, added Lurie. “While the pace of monthly gains is expected to slow in the second half of the year, limited supply choice is expected to keep prices elevated throughout the second half of the year.”

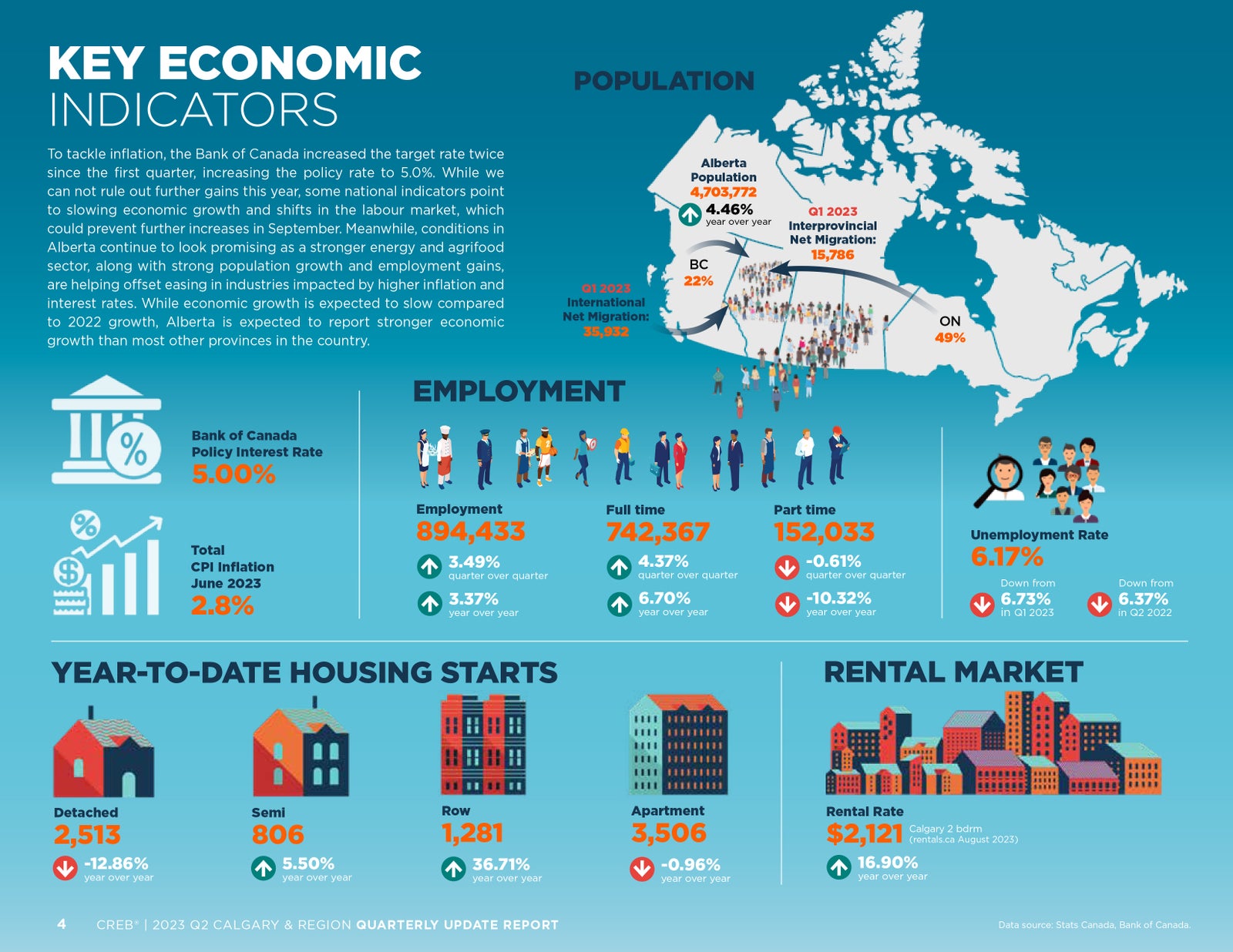

Economic Update

To tackle inflation, the Bank of Canada increased the target rate twice since the first quarter, increasing the policy rate to 5.0%. While we can not rule out further gains this year, some national indicators point to slowing economic growth and shifts in the labour market, which could prevent further increases in September. Meanwhile, conditions in Alberta continue to look promising as a stronger energy and agrifood sector, along with strong population growth and employment gains, are helping offset easing in industries impacted by higher inflation and interest rates. While economic growth is expected to slow compared to 2022 growth, Alberta is expected to report stronger economic growth than most other provinces in the country.

Housing Market

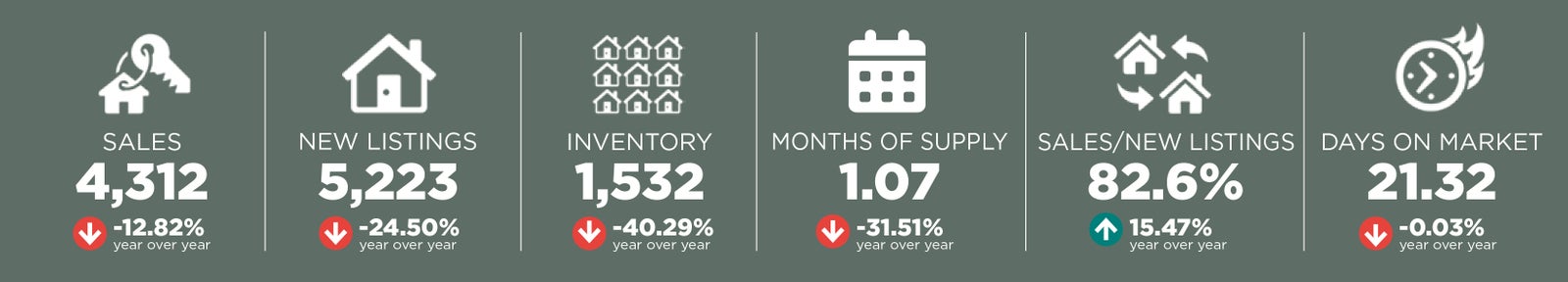

Detached

Limited supply choice in the lower price ranges has weighed on sales activity in the detached sector, which accounts for only 48 percent of all residential sales as of the second quarter. Compared to last year, quarterly sales activity improved for homes priced over $600,000, but it was not enough to offset the pullbacks in the lower price ranges. The pullback in the lower price ranges was primarily due to a lack of inventory. Detached inventories neared the quarterly record low that occurred in 2006, but homes priced below $600,000 reported the largest decline and now account for only 26 percent of the total inventory.

Despite higher lending rates, sales activity continued to improve in the upper price ranges; in part, this can be related to the strong interprovincial migration from Ontario and British Columbia. While conditions remain the tightest in the lower price ranges, the strength in higher price sales ensured conditions remained tight across all price ranges. The persistently tight conditions placed further upward pressure on detached home prices. Detached benchmark prices rose across all districts, with the largest quarterly and year-over-year gain occurring in the most affordable districts of the East and North East.

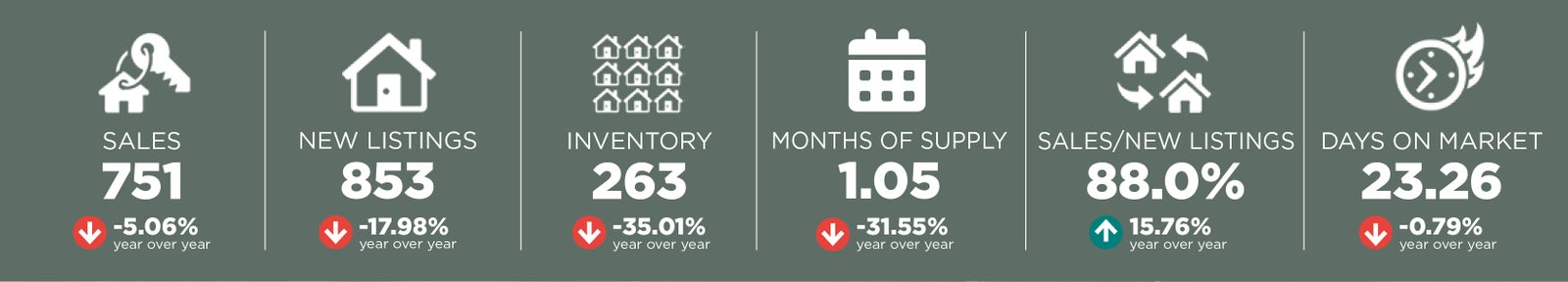

Semi-Detached

With 853 new listings and 751 sales in the second quarter, the sales-to-new listings ratio rose to 88 percent, preventing any significant change in the low inventory levels. Like the detached sector, limited supply choices in the lower price ranges contributed to declining sales for lower-priced properties. And while sales activity improved for higher priced units, it was not enough to offset the declines for homes priced below $500,000.

With only one month of supply, conditions continued to favour the seller, causing prices to rise to a new record high. Prices rose across all districts, with the highest year-over-year gains occurring in the North East and East districts. Overall, the unadjusted benchmark price reached $601,867 in Calgary, nearly six percent higher than the first quarter and a four percent increase over the second quarter of 2022.

Row/Townhome

The relative affordability for Row properties ensured that sales activity remained strong relative to long-term trends. However, with 1,608 new listings in the second quarter and 1,436 sales, the sales-to-new listings ratio rose to 89 percent, keeping inventories exceptionally low. Like the detached and semi-detached sectors, sales activity slowed for lower-priced properties due to limited supply choices.

Averaging less than one month of supply in the second quarter, row properties reported the tightest conditions across all property types. Benchmark prices rose across all districts, with the strongest year-over-year gains occurring in the North East, South and East districts, which are also the most affordably priced in the city. Overall, the city-wide benchmark price reached a new quarterly high of $390,733, nearly nine percent higher than Q2 2022 and seven percent higher than the previous quarter.

Apartment

Higher lending rates and rising rental costs have supported a turnaround in the apartment condominium sector. This sector has lagged behind the rest of the market, but sales and new listings have reported a record high as of the second quarter. The growth in sales was only possible thanks to the supply choice in this sector. However, the shift in sales relative to supply did cause conditions to tighten with a sales-to-new listings ratio of 81 percent and just over one month of supply.

Tightening conditions supported further price gains in this sector, resulting in an unadjusted price recovery from 2014. As of the second quarter, the unadjusted benchmark price reached $298,633, a six percent gain over the first quarter and over 11 percent higher than last year’s levels. While the quarterly price has set new record highs, prices in the City Centre remain just below the 2014 peak.