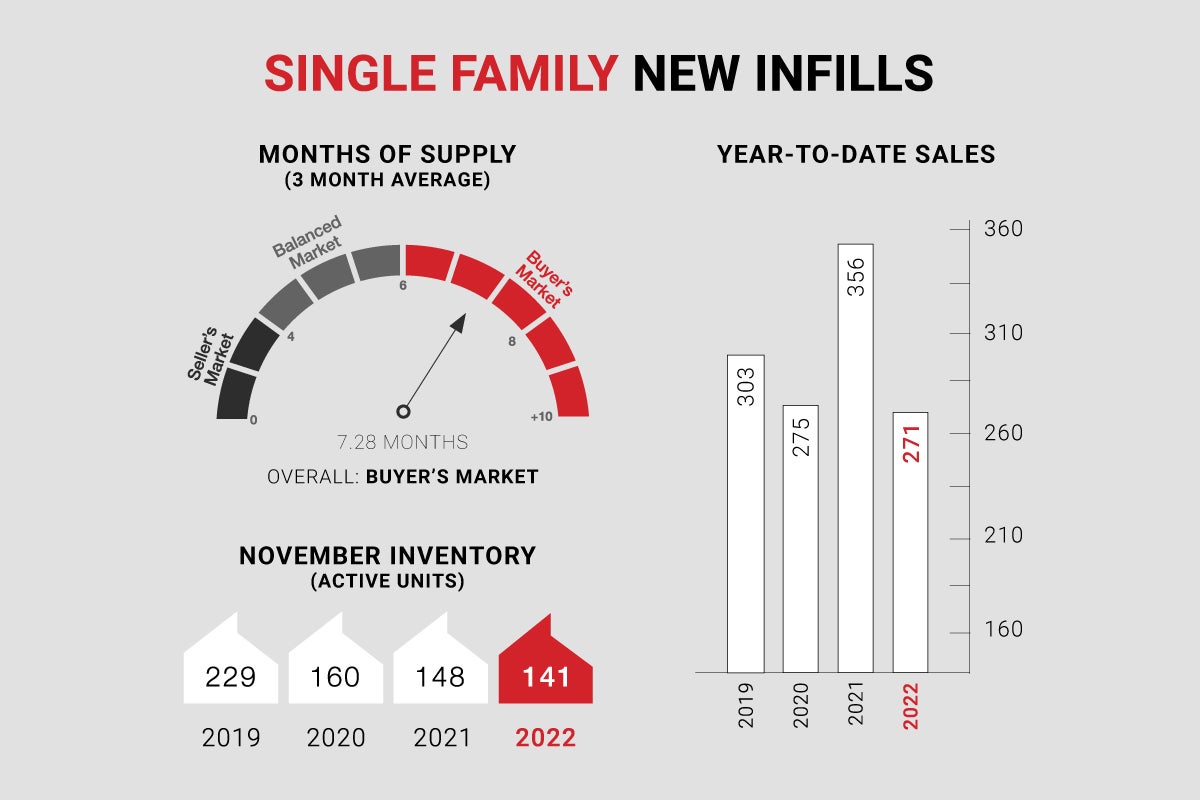

Single-family new infills posted 24 sales during the month of November, up considerably from the 13 sales recorded last month however still down from the 39 sales posted in November of last year.

Year-to-date single-family sales sit at 271, down almost 24% from the same period in 2021 however, down only 1.5% from the same period in 2020.

Single-family new infill inventory has increased, to 141 active listings, from 129 active listings recorded last month and is also down from the 148 active listings recorded at this time last year. Year-to-date average inventory sits at 124 active listings, down 15% compared to 2021 and down over 35% compared to 2020.

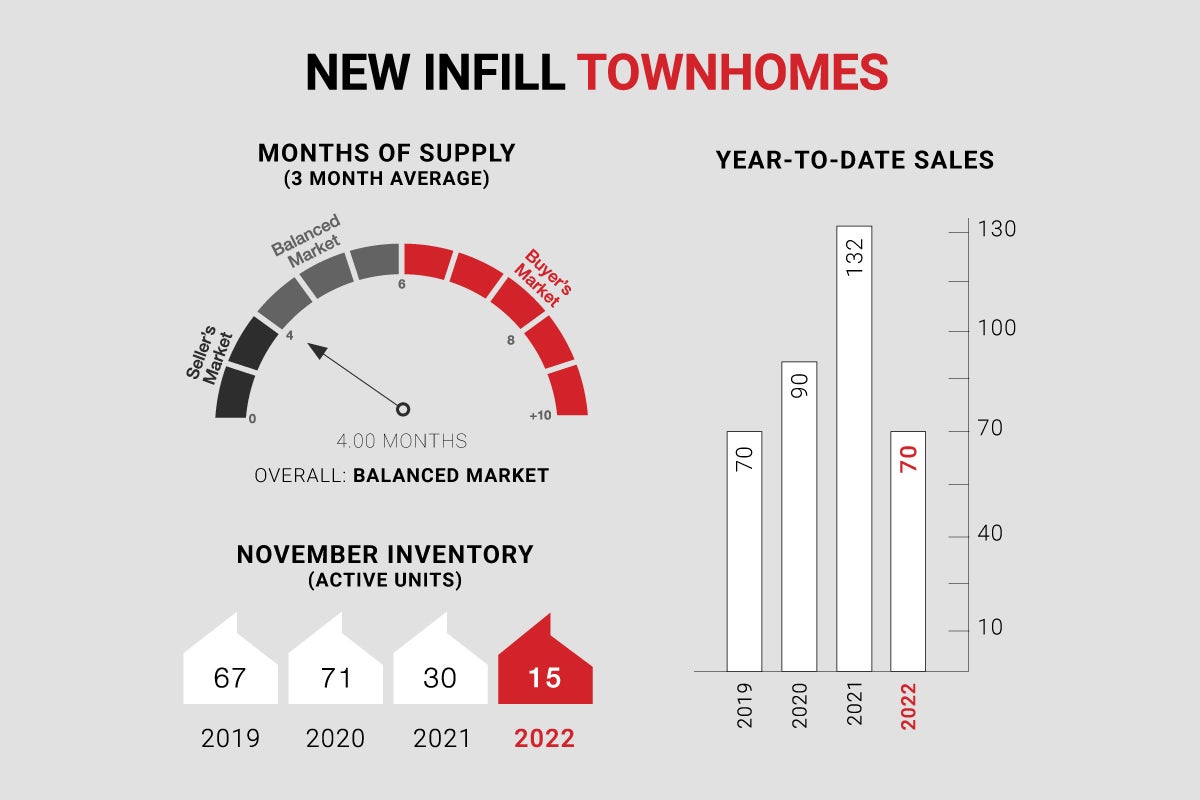

New infill townhomes posted 5 sales during the month of November, up from the 3 sales recorded last month and down from the 6 sales recorded in November of last year. Year-to-date townhome sales are at 70, down 47% from the same period in 2021 however, and down 22% from the same period in 2020.

New infill townhome inventory has declined to 15 active units for sale from 16 active units recorded last month and is down considerably from the 30 active units recorded at this time last year. Year-to-date average townhome inventory sits at 21, down over 53% compared to 2021 and down almost 67% compared to 2020.

Sales activity is expected to ease slightly throughout the month of December as attention shifts toward seasonal festivities. We eagerly anticipate next week's interest rate announcement as it will set the stage for sales activity in the New Year.

From all of us at Urban Upgrade & NewInfills, we wish you all the best this Holiday Season!

CALGARY MARKET UPDATE (CREB)

City of Calgary, December 1, 2022 - Residential sales in the city slowed to 1,648 units, a year-over-year decline of 22 per cent, but 12 per cent above the 10-year average.

The pullback in sales over the past six months was not enough to erase gains from earlier in the year as year-to-date sales remain nearly 10 per cent above last year’s record high. The year-to-date sales growth has been driven by a surge in both apartment condominium and row sales.

“Easing sales have been driven mostly by declines in the detached sector of the market,” said CREB® Chief Economist Ann-Marie Lurie. “Higher lending rates are impacting purchasers buying power, and limited supply choice in the lower price ranges of the detached market is likely causing many purchasers to place buying decisions on hold.”

A decline in sales was met with a pullback in new listings, and inventories fell to the lowest level reported in November since 2005. The pullback in both sales and new listings kept the months of supply relatively tight at below two months. The tightest conditions are occurring in the lower-price ranges as supply growth has mostly been driven by gains in the upper end of the market.

Despite the lower supply levels, prices have trended down from the peak reached in May of this year. Even with the adjustments that have occurred, November benchmark prices continue to remain nearly nine per cent higher than levels reported last year.

The pullback in sales over the past six months was not enough to erase gains from earlier in the year as year-to-date sales remain nearly 10 per cent above last year’s record high. The year-to-date sales growth has been driven by a surge in both apartment condominium and row sales.

“Easing sales have been driven mostly by declines in the detached sector of the market,” said CREB® Chief Economist Ann-Marie Lurie. “Higher lending rates are impacting purchasers buying power, and limited supply choice in the lower price ranges of the detached market is likely causing many purchasers to place buying decisions on hold.”

A decline in sales was met with a pullback in new listings, and inventories fell to the lowest level reported in November since 2005. The pullback in both sales and new listings kept the months of supply relatively tight at below two months. The tightest conditions are occurring in the lower-price ranges as supply growth has mostly been driven by gains in the upper end of the market.

Despite the lower supply levels, prices have trended down from the peak reached in May of this year. Even with the adjustments that have occurred, November benchmark prices continue to remain nearly nine per cent higher than levels reported last year.