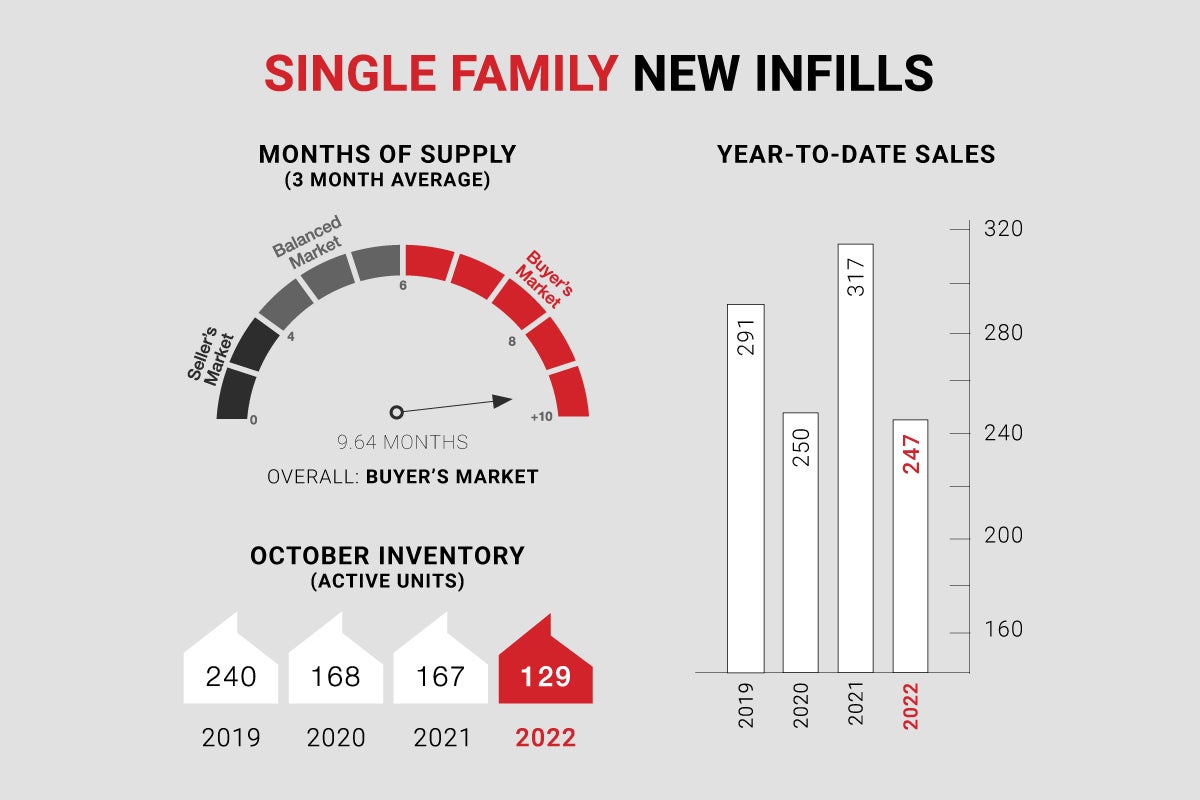

Single-family new infills posted 13 sales during the month of October, down from the 17 sales recorded last month and down from the 20 sales posted in October of last year.

Year-to-date single-family sales sit at 247, down over 22% from the same period in 2021 but down only 1% from the same period in 2020.

Single-family new infill inventory has decreased further, to 129 active listings, from 123 active listings recorded last month and down from the 167 active listings recorded at this time last year. Year-to-date average inventory sits at 122 active listings, down 16% compared to 2021 and down over 36% compared to 2020.

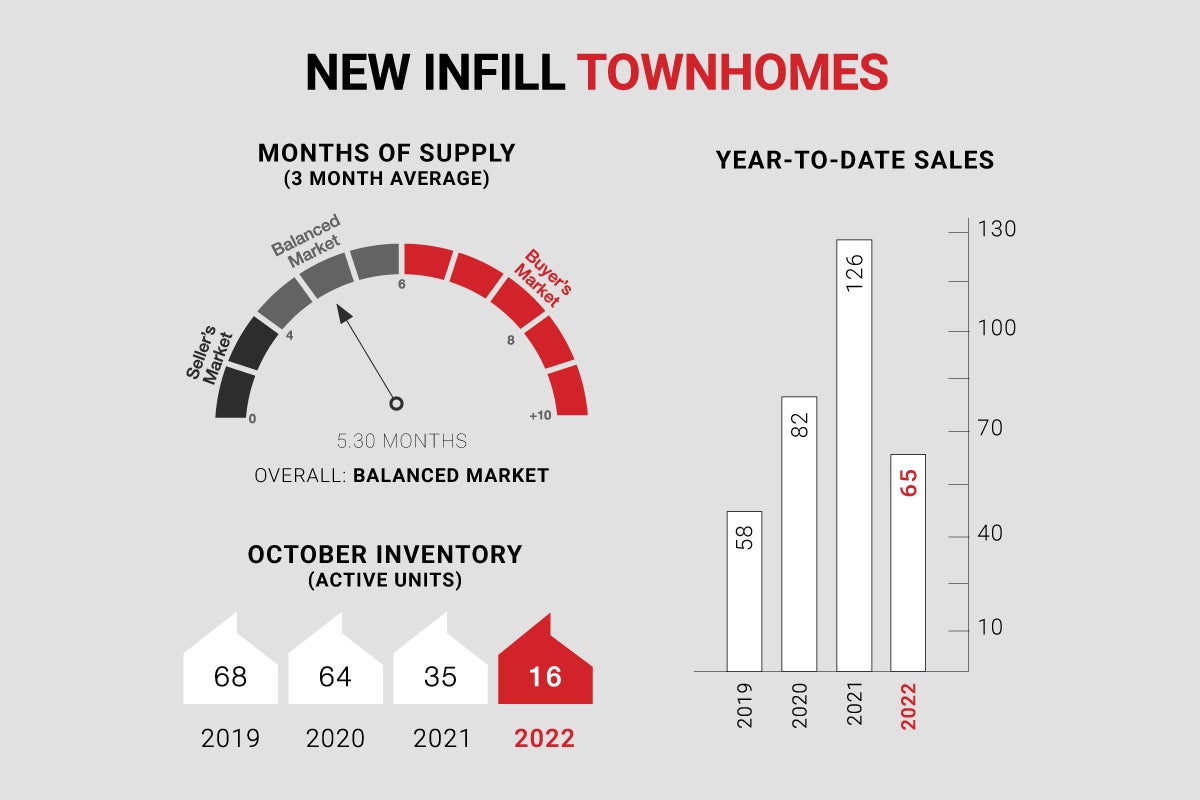

New infill townhomes posted 3 sales during the month of October, down from the 4 sales recorded last month and considerably down from the 11 sales recorded in October of last year. Year-to-date townhome sales sit at 65, down over 48% from the same period in 2021 however, down only 20% from the same period in 2020.

New infill townhome inventory has declined further to 16 active units for sale, from 17 active units recorded last month, and is down considerably from the 35 active units recorded at this time last year. Year-to-date average townhome inventory sits at 22, down over 52% compared to 2021 and down over 65% compared to 2020.

As the holiday season fast approaches and interest rates bump higher once again, sales activity throughout the new infill sector is expected to ease with inventories inching upwards.

CALGARY MARKET UPDATE (CREB)

City of Calgary, November 1, 2022 - October sales eased compared to last year’s levels, mostly due to slower activity in the detached sector.

However, with 1,857 sales this month, levels are still stronger than long-term trends and activity reported prior to the pandemic. Year-to-date sales have reached 26,823 and with only two months to go, 2022 will likely post a record year in terms of sales.

“Calgary hasn’t seen the same degree of pullback in housing sales like other parts of Canada, thanks to persistently strong demand for our higher density product,” said CREB® Chief Economist Ann-Marie Lurie. “While our city is not immune to the impact that inflation and higher rates are having, strong employment growth, positive migration flows and a stronger commodity market are helping offset some of that impact.”

New listings also trended down this month causing the sales-to-new-listings ratio to rise to 85 per cent and inventories to trend down. Much of the inventory decline has been driven by product priced below $500,000.

While conditions are not as tight as what was seen earlier in the year, with only two months of supply, conditions remain tighter than historical levels. We are also seeing divergent trends in the market with conditions continuing to favour the seller in the lower-price ranges and shifting to more balanced conditions in the upper-price ranges.

As of October, prices have eased by four per cent relative to the highs reached in May. This is considered a relatively small adjustment when considering price movements in other large cities. It is also important to note that the October benchmark price is still nearly 10 per cent higher than levels reported last year.