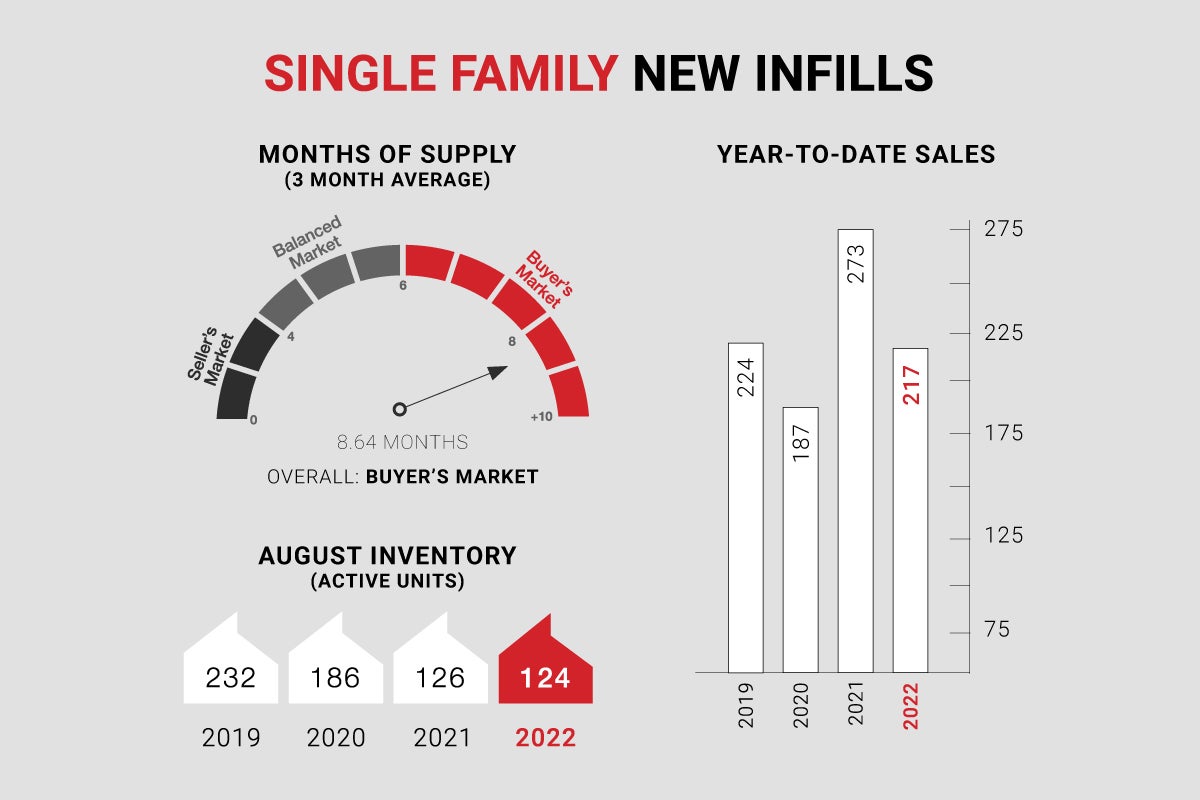

Single-family new infills posted only 9 sales during the month of August, down from the already low 14 sales posted in July and considerably down from the 24 sales recorded in August of last year. Year-to-date single-family sales are sitting at 218, down over 20% from the same period in 2021, however up 16% from the same period in 2020.

Single-family new infill inventory has increased slightly, to 124 active listings, from 119 active listings recorded last month but slightly down from the 126 active listings recorded at this time last year. Year-to-date average inventory sits at 121 active listings, down 17% compared to 2021 and down over 36% compared to 2020.

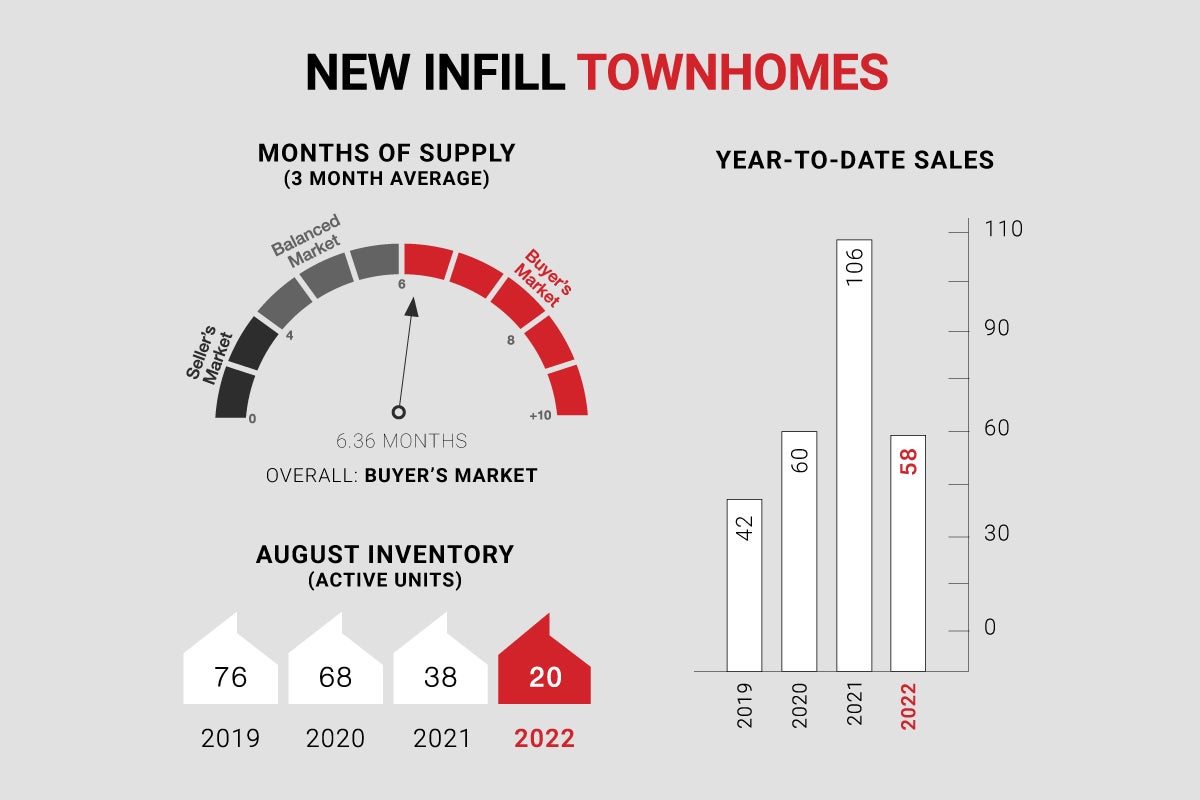

New infill townhomes posted only 3 sales during the month of August, slightly up from the 2 sales recorded last month but considerably down from the 8 sales recorded in August of last year. Year-to-date townhome sales sit at 58, down over 45% from the same period in 2021; however, only down about 3% from the same period in 2020.

New infill townhome inventory is down to 20 active units for sale, from 25 active units recorded last month, and is also down from the 38 active units recorded at this time last year. Year-to-date average townhome inventory sits at 23, down approximately 50% compared to 2021 and down almost 64% compared to 2020.

Sales activity is expected to strengthen over the coming weeks as kids head back to school and buyers resume their searches without being distracted by summer holidays. Although sales activity in the single-family sector is weaker than usual for our market, available inventory is partially to blame as only 35% of active listings are completed homes, whereas 65% of active listings are under construction. By contrast, 75% of townhomes for sale are move-in ready, whereas only 25% are under construction.

CALGARY MARKET UPDATE (CREB)

City of Calgary, September 1, 2022 – August sales activity was comparable to the strong levels recorded last year and well above long-term trends for the month.

While sales have remained relatively strong, there continues to be a shift towards more affordable options as the year-over-year pullback in detached sales was nearly matched by gains for multi-family product types.

“While higher lending rates have slowed activity in the detached market, we are still seeing homebuyers shift to more affordable options which is keeping sales activity relatively strong,” said CREB® Chief Economist Ann-Marie Lurie. “This makes Calgary different than some of the larger cities in the country which have recorded significant pullbacks in sales.”

At the same time, new listings continue to trend down, preventing any supply gains or a substantial shift in the months of supply.

Despite year-over-year gains in new listings, the spread between new listings and sales this month narrowed compared to the past three months. This caused total inventory to trend down and prevented any significant shift in the months of supply. The months of supply in August remained at just above two months, not at tight as earlier in the year, but still below levels traditionally seen this time of year.

For the third month in a row, benchmark prices eased declining to $531,800. While the reduction reflects shifting market conditions, it is important to note that previous gains are not lost, and prices remain over 11 per cent higher than last year.

While sales have remained relatively strong, there continues to be a shift towards more affordable options as the year-over-year pullback in detached sales was nearly matched by gains for multi-family product types.

“While higher lending rates have slowed activity in the detached market, we are still seeing homebuyers shift to more affordable options which is keeping sales activity relatively strong,” said CREB® Chief Economist Ann-Marie Lurie. “This makes Calgary different than some of the larger cities in the country which have recorded significant pullbacks in sales.”

At the same time, new listings continue to trend down, preventing any supply gains or a substantial shift in the months of supply.

Despite year-over-year gains in new listings, the spread between new listings and sales this month narrowed compared to the past three months. This caused total inventory to trend down and prevented any significant shift in the months of supply. The months of supply in August remained at just above two months, not at tight as earlier in the year, but still below levels traditionally seen this time of year.

For the third month in a row, benchmark prices eased declining to $531,800. While the reduction reflects shifting market conditions, it is important to note that previous gains are not lost, and prices remain over 11 per cent higher than last year.