“Despite challenges with COVID-19, we are starting to see a turnaround in our job and migration numbers, and while interest rates are expected to rise, they remain relatively low. All these factors are expected to support strong housing demand into 2022,” said CREB®Chief Economist Ann-Marie Lurie.

“The biggest question will be whether supply can meet that demand. It will take time for housing to move out of sellers’ market conditions, so we do anticipate prices will continue to rise this year.”

Rising lending rates are expected to cool some of the demand later this year, but rates are still exceptionally low, supporting strong housing sales, especially from those who experienced increased savings and equity gains throughout the pandemic. Economic improvements are also expected to support both job and population growth, adding new sources of demand for housing.

During the pandemic, supply has been a struggle for many industries, including the housing market. New listings have improved, but it has not been enough to offset high sales levels, keeping inventories relatively low and likely limiting sales growth in the market.

As we move through 2022, new listings in the resale market should remain relatively strong thanks to higher home prices. At the same time, the new-home sector recorded a surge in starts last year, and the completion of those starts should help add to overall supply choice in the market.

Supply levels are expected to improve relative to demand this year. However, conditions are expected to remain relatively tight throughout the spring market, supporting further price gains.

As the market balance gradually improves, upward price pressure in the housing market should ease. Overall, price growth is expected to ease to four per cent in 2022.

“While conditions in the housing market are expected to remain strong, there is a significant amount of uncertainty that could impact housing,” said Lurie.

“If supply levels remain low relative to demand, we could see stronger-than-expected price growth. On the other hand, if rates rise much faster and higher than expected, it could cause a more significant pullback in sales.”

2022 CREB FORECAST SUMMARY

Housing market sales in 2022 are expected to moderate relative to record levels of activity in 2021, while remaining stronger than historical levels.Rising lending rates are expected to cool some of the demand later this year, but rates are still exceptionally low, supporting strong housing sales, especially from those who experienced increased savings and equity gains throughout the pandemic. Economic improvements are also expected to support both job and population growth, adding new sources of demand for housing. Overall, all of these factors point toward relatively strong sales in 2022.

Throughout the pandemic, supply has been a struggle for many industries, including the housing market. New listings have improved, but it has not been enough to offset high sales levels, keeping inventories relatively low and likely limiting sales growth in the market. As we move through 2022, new listings in the resale market should remain relatively strong thanks to higher home prices. At the same time, the new-home sector recorded a surge in starts last year. The completion of those starts should help add to the overall supply choice in the market.

Supply levels are expected to improve relative to demand this year. However, conditions are expected to remain relatively tight throughout the spring market, supporting further price gains. As the market balance gradually improves, upward price pressure in the housing market should ease. Overall, annual price growth is expected to slow to four per cent in 2022.

TOP CONSIDERATIONS FOR 2022:

Throughout the pandemic, supply has been a struggle for many industries, including the housing market. New listings have improved, but it has not been enough to offset high sales levels, keeping inventories relatively low and likely limiting sales growth in the market. As we move through 2022, new listings in the resale market should remain relatively strong thanks to higher home prices. At the same time, the new-home sector recorded a surge in starts last year. The completion of those starts should help add to the overall supply choice in the market.

Supply levels are expected to improve relative to demand this year. However, conditions are expected to remain relatively tight throughout the spring market, supporting further price gains. As the market balance gradually improves, upward price pressure in the housing market should ease. Overall, annual price growth is expected to slow to four per cent in 2022.

TOP CONSIDERATIONS FOR 2022:

COVID-19 IMPACTS ON ECONOMY AND INFLATION

COVID-19 IMPACTS ON ECONOMY AND INFLATIONSupply disruptions caused by COVID-19 are expected to ease in 2022. However, if new variants emerge that delay a full re-opening, this could impact the economic recovery, while prolonging supply challenges and inflationary pressure.

LENDING

LENDINGThe Bank of Canada is expected to increase interest rates in 2022. While gradual gains are anticipated, rates are expected to remain below pre-pandemic levels – low enough to continue to support housing demand, but not at the pace seen in 2021.

POPULATION

POPULATIONThe flow of migration will be an important component of sustaining high levels of demand in housing markets.

HOUSING SUPPLY

HOUSING SUPPLYNew construction and elevated levels of listings in the resale market are expected to help add to the undersupplied housing market. The spring market is expected to remain relatively tight, but if supply levels do not start to improve in the second half of the years, this will have significant implications for home prices.

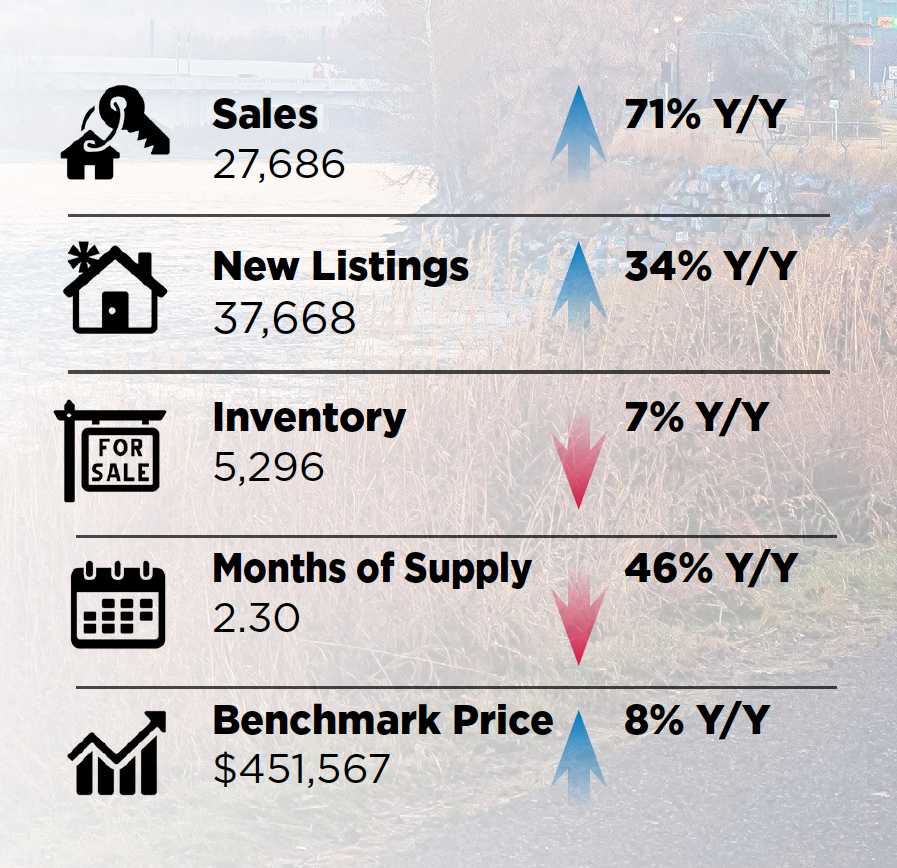

CALGARY RESALE MARKET ACTIVITY - 2021 REVIEW

Housing market activity in 2021 far exceeded our expectations, as sales in the city surpassed record highs set back in 2006. Both sales and prices were expected to improve, but the annual pace of growth was far stronger than forecasted. Demand was exceptionally strong throughout the spring as expected, but supply levels did not rise enough to meet that demand, causing stronger-than-expected price growth. The pace of sales growth did slow through the latter half of the year, but the growth was still stronger than the gains in new listings, preventing the market from returning to balanced conditions.The persistent sellers’ market conditions in 2021 contributed to an annual price gain of over eight per cent. After significant price declines for the better part of the past five years, the shift toward sellers’ market conditions helped support the recovery in home prices. Home prices hit new highs in the detached and semi-detached sectors, but improvements in the row and apartment sectors were not enough to support full price recovery.

WHY WAS DEMAND SO STRONG?

Last year saw some of the lowest mortgage rates on record. Levels did rise from the lows reported earlier in the year, but rates remained far below what was available in the market before the pandemic. This was one of the main drivers of the strong housing demand growth recorded in 2021.

As restrictions prevented many from travelling or spending as much as they typically would on recreational activities, household savings improved across the country. Improved savings among those whose incomes were not impacted by the pandemic, as well as more hybrid work arrangements and our young demographic, led many consumers to purchase homes. Activity showed signs of slowing down moving into the fourth quarter. However, that abruptly changed as concerns over inflation and future rate increases supported another surge in demand from buyers looking to get into the market before any rate changes took effect.

Rising prices and longer construction timelines in the new-home sector caused many buyers to consider their options in the resale market, which saw a larger increase in activity relative to the new-home market in 2021.

HOUSING IN 2022

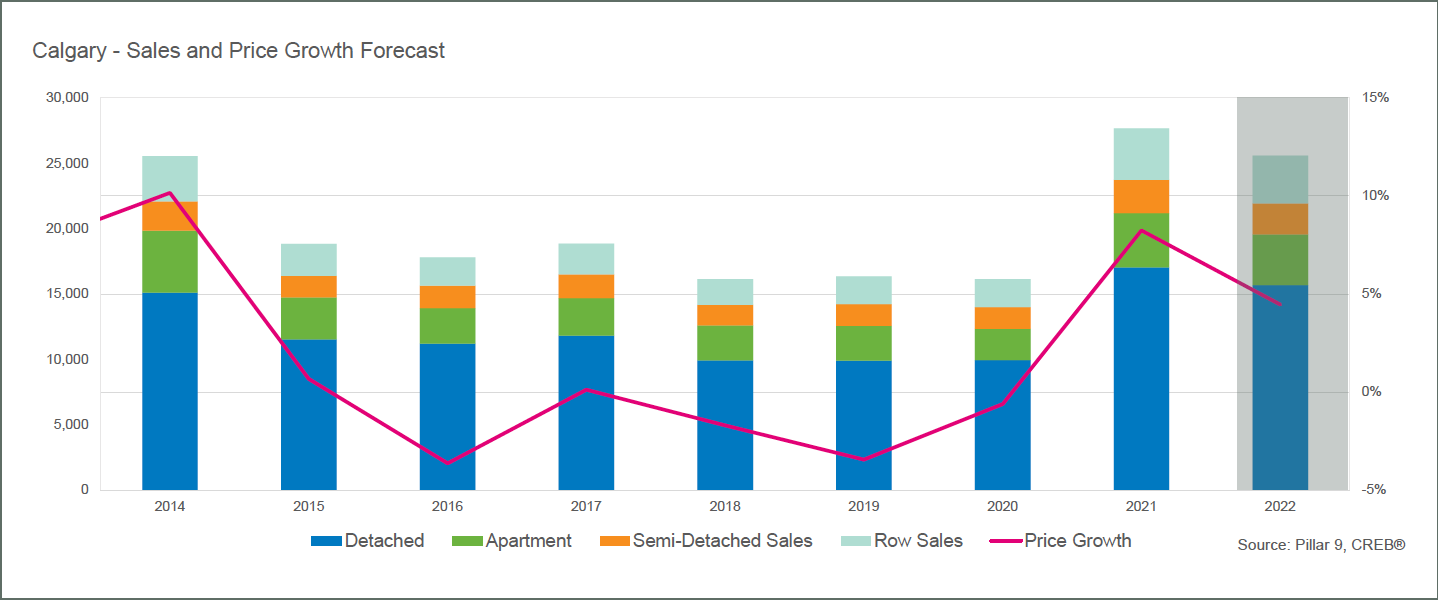

Rising lending rates and higher home prices are expected to slow demand growth in 2022, bringing sales down from 2021’s record levels. However, overall, levels are expected to remain much higher than long-term trends, reflecting a strong demand environment. As we move through the economic recovery and job prospects improve, demand for resale housing will remain relatively strong.

The challenge in 2022 is expected to be related to supply. Starts activity did improve last year, which should help

with overall housing supply in 2022, but resale supply may struggle to remain at adequate levels to support balanced conditions throughout the earlier part of the year.

with overall housing supply in 2022, but resale supply may struggle to remain at adequate levels to support balanced conditions throughout the earlier part of the year.

Higher prices should prevent a significant slide in new listings growth this spring, ensuring conditions are not as tight as in 2021. However, the return of more balanced conditions is not expected until the latter part of 2022. The slow return to balanced conditions is expected to continue to support price gains this year, albeit at a slower pace than in 2021. Overall, citywide annual prices are forecasted to increase by over four per cent.

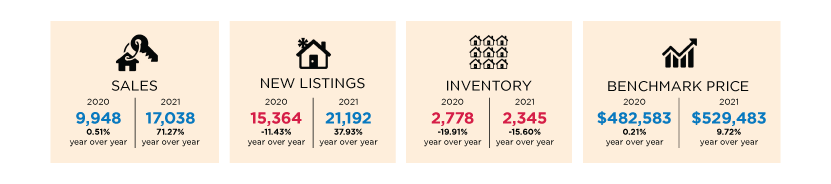

HOUSING MARKET - DETACHED

The combination of consumers’ desire for more space and easing lending rates helped detached home sales in 2021 improve by over 71 per cent compared to the previous year. The total of 17,038 sales was just shy of the record set in 2005. The strongest demand started in the lower price ranges, but supply eased, creating exceptionally tight conditions in the lower end of the market that impacted prices. The price gains in the lower end also provided more opportunity for move-up buyers looking to take advantage of those gains, as conditions were not as tight in the upper price ranges. However, by the end of the year, supply/demand balances tightened across every price range, with less than two months of supply for all detached homes priced under $700,000.

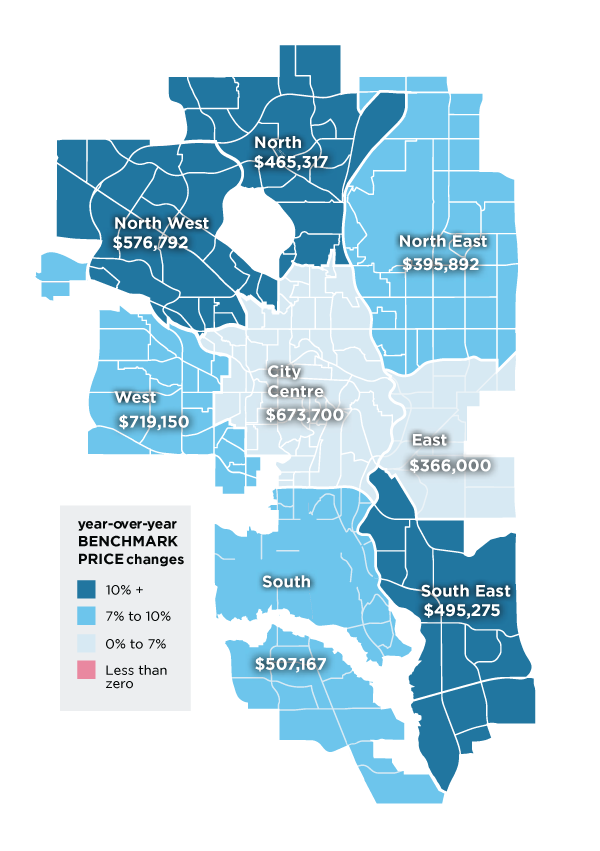

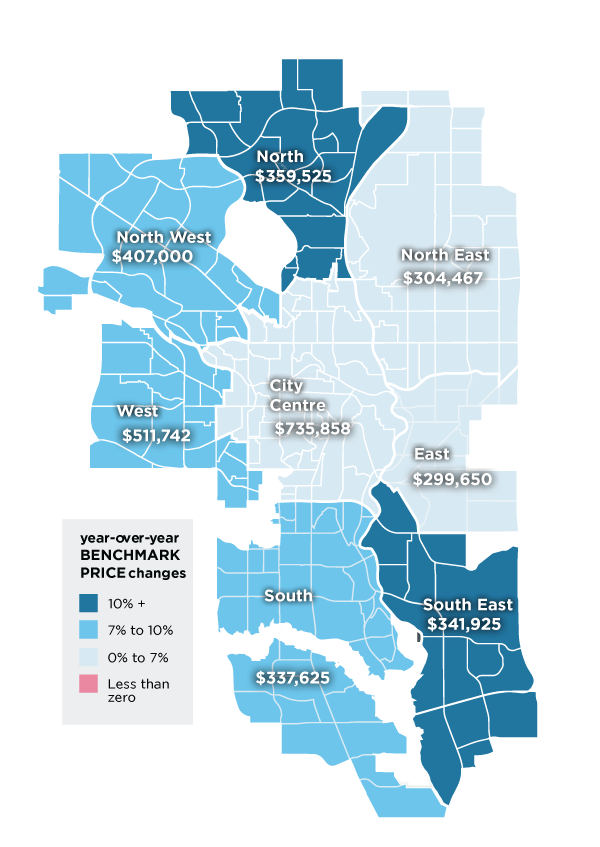

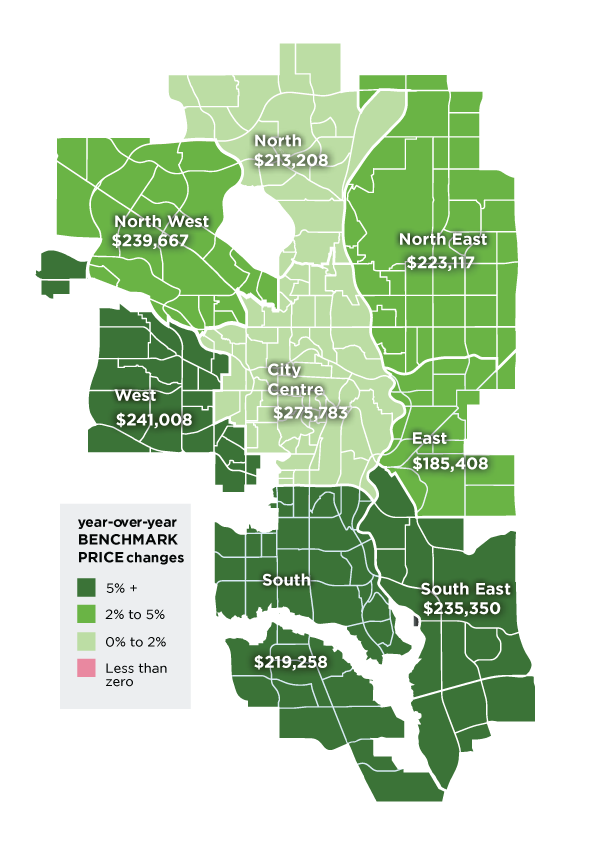

Persistent sellers’ market conditions resulted in benchmark home prices rising by nearly 10 per cent in 2021, the highest increase among all property types. This reflected a full recovery and new record-high price for detached homes. Price gains did vary significantly from district to district, ranging from nearly 12 per cent in the South East to a low of six per cent in the City Centre. The City Centre was the only district where prices did not recover to previous highs.

As we move into 2022, we will be starting the year from a place of exceptionally low levels of supply relative to demand. From August 2021 onward, the sales-to-new-listings ratio remained around 80 per cent for the rest of the year, accelerating the decline in inventory levels and pushing the months of supply down to just over one month, something that has not happened in over a decade. The strong sales growth in 2021 far outpaced any gains in new listings, leaving inventory levels over 20 per cent lower than long-term trends.

Rising rates and higher prices should slow demand from the record levels seen in 2021, but demand is expected to remain relatively strong in 2022. At the same time, supply is still expected to struggle to keep pace, especially during the first half of the year. Supply options in the new-home market and higher prices should keep new listings above long-term averages, but it will take some time before the detached sector returns to more balanced conditions. With tight market conditions likely to persist during the early part of the year, detached home prices are expected to continue recording strong price gains, increasing by over five per cent in 2022.

HOUSING MARKET - SEMI-DETACHED

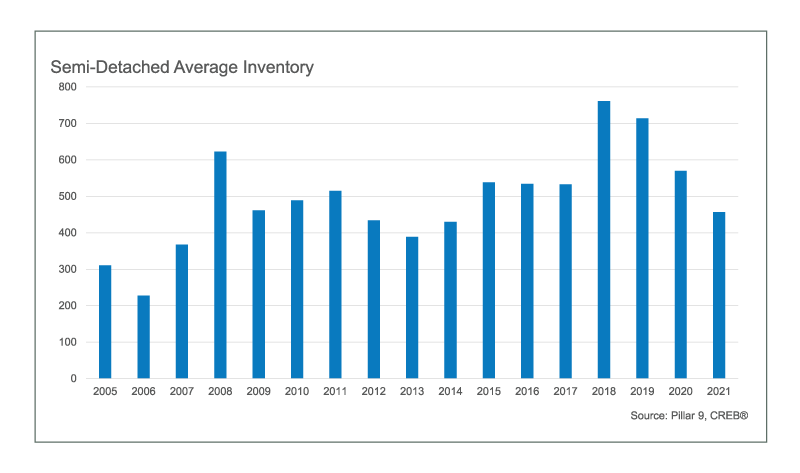

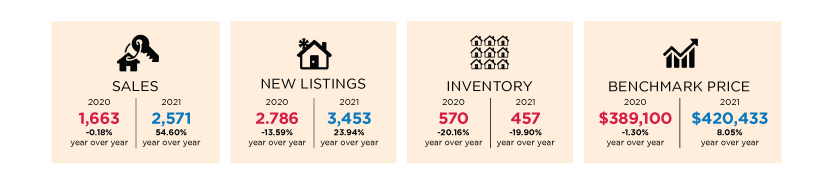

Demand for semi-detached homes remained exceptionally strong in 2021, reaching record levels and leading to sales nearly 50 per cent higher than long-term averages. New listings increased, but it was not enough to offset the sales growth. On average, inventories declined by nearly 20 per cent in 2021 and were nearly 16 per cent lower than long-term trends.

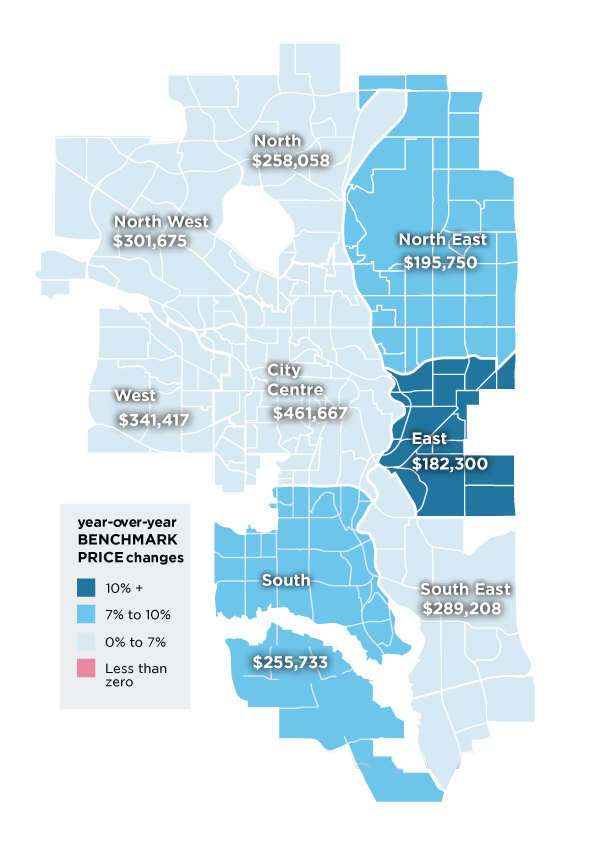

The end result was persistent sellers’ market conditions in the semi-detached sector, resulting in an annual benchmark price gain of eight per cent in 2021. Price gains occurred in every district. Overall, prices recovered to previous highs, but prices in the City Centre, North East and South fell short of previous highs for those districts.

In 2022, sales activity is expected to slow but remain well above long-term trends. Like the detached sector, the semi-detached sector will take time to return to more balanced conditions, supporting further price gains in 2022 – albeit at a slower pace.

HOUSING MARKET - ROW

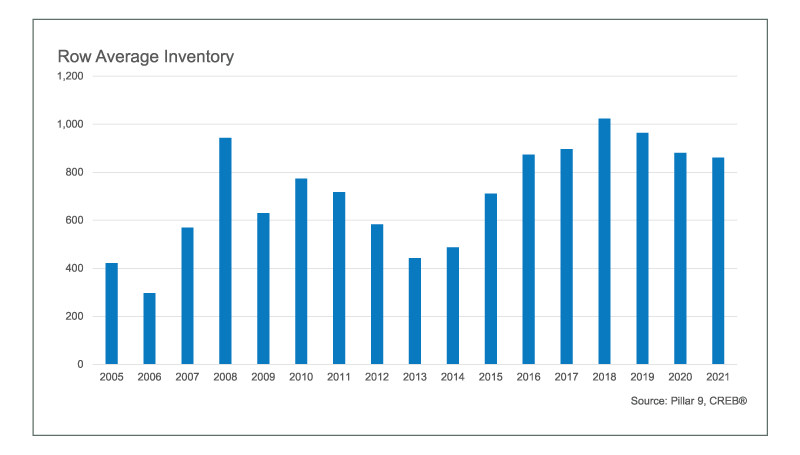

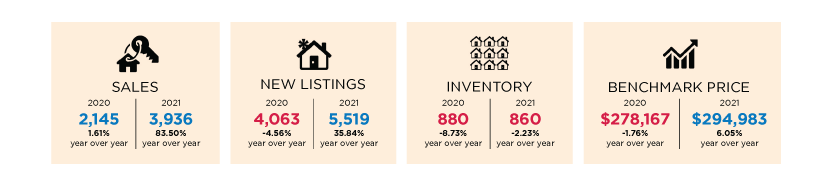

Row sales activity reached record levels in 2021, with 3,936 sales. Thanks to significant improvements in new listings earlier in the year, inventory levels improved throughout the busier spring months and conditions did not get as tight as what was seen in the detached or semi-detached sectors.

By the end of the year, persistent sales growth started to cause inventories to ease and market conditions to tighten to some of the lowest levels seen since 2014. As it did take longer for the market to shift into sellers’ conditions, price 800 gains were not as strong for row homes as they 600 were for some home types. On an annual basis, row 400 benchmark prices improved by six per cent. While the 200 recent gains helped erase some of those losses, prices remain nearly nine per cent lower than previous highs.

Unlike detached and semi-detached homes, row home inventory levels remained higher than long-term averages in 2021. As demand slows, this segment of the market will move into balanced conditions sooner, as supply challenges were not as prevalent for this property type. These balanced conditions will slow the pace of price growth in 2022.

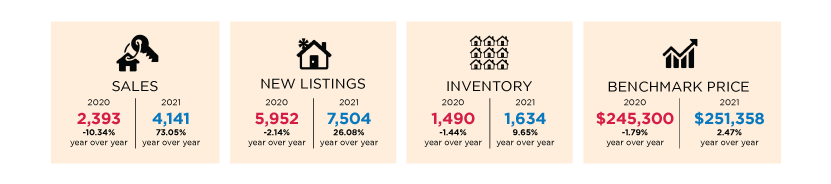

HOUSING MARKET - APARTMENT

Prior to the pandemic, the apartment condominium sector was struggling with excess supply and consecutive annual price declines from 2015 to 2020. In 2021, we saw demand improve enough to help shift the market toward balanced conditions and those conditions supported price growth of just over two per cent. The reversal in price trends is welcome news to condo sellers, but this segment never saw conditions shift to favour the seller and prices remain over 14 per cent lower than previous highs.

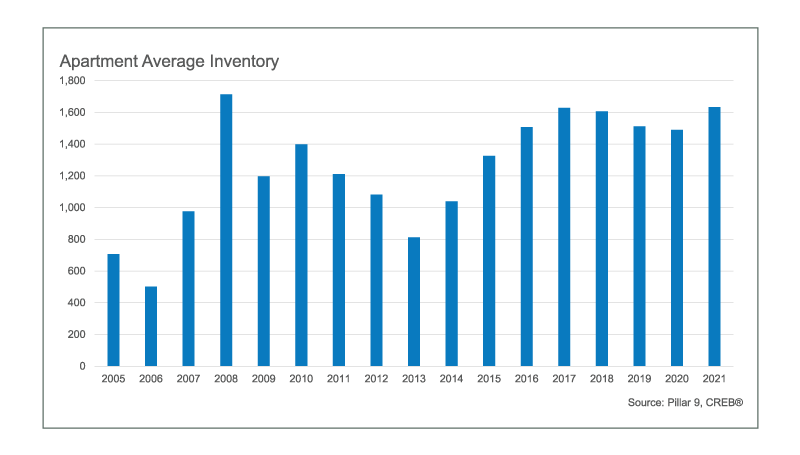

In 2021, average inventory levels for apartment condominiums were still higher than levels seen in 2020 and well above long-term trends. Unlike other property types, where both demand growth and supply restrictions drove the sellers’ market conditions, balanced conditions in the apartment sector were driven by the growth in demand.

In 2022, rate gains and further price increase are expected to keep demand in this sector relatively strong, as more people seek out affordable product. However, given that supply levels are not an issue, we do not expect to see any further tightening in this market. Persistent balanced conditions should continue to support modest price growth for apartment condominiums in 2022.

Source: Creb 2022 Forecast