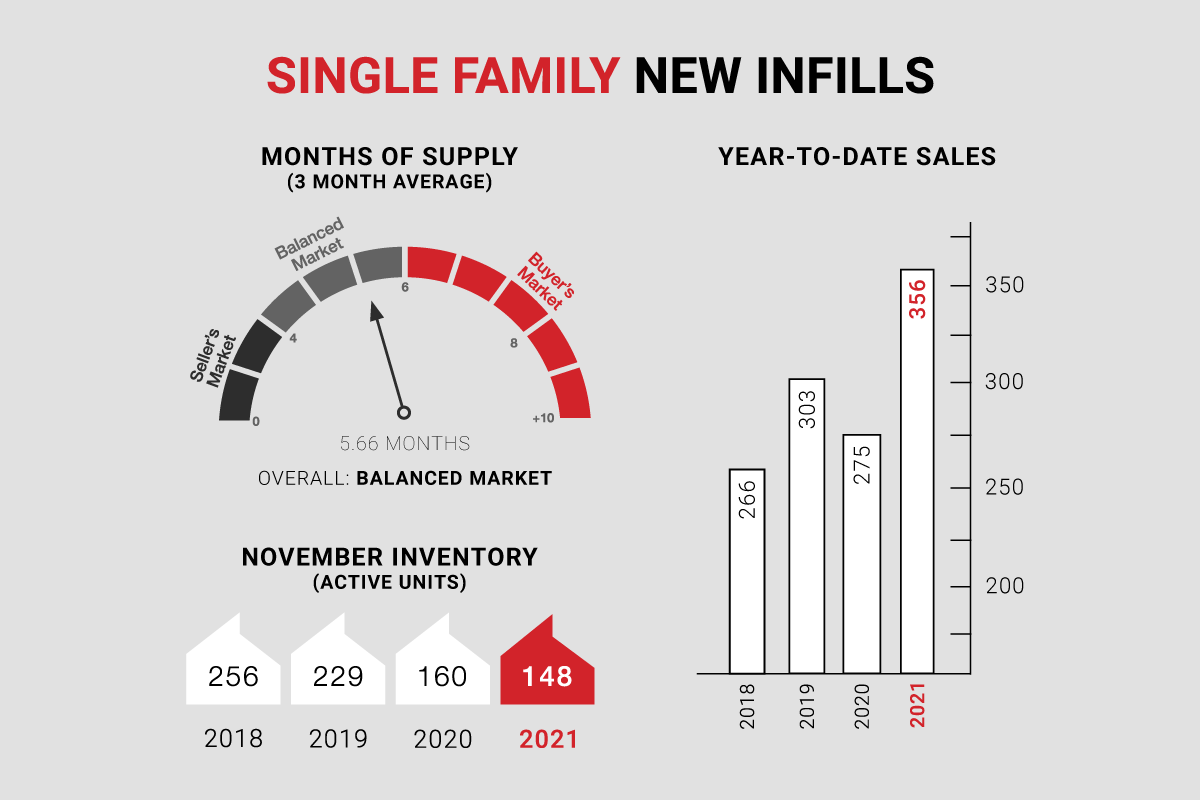

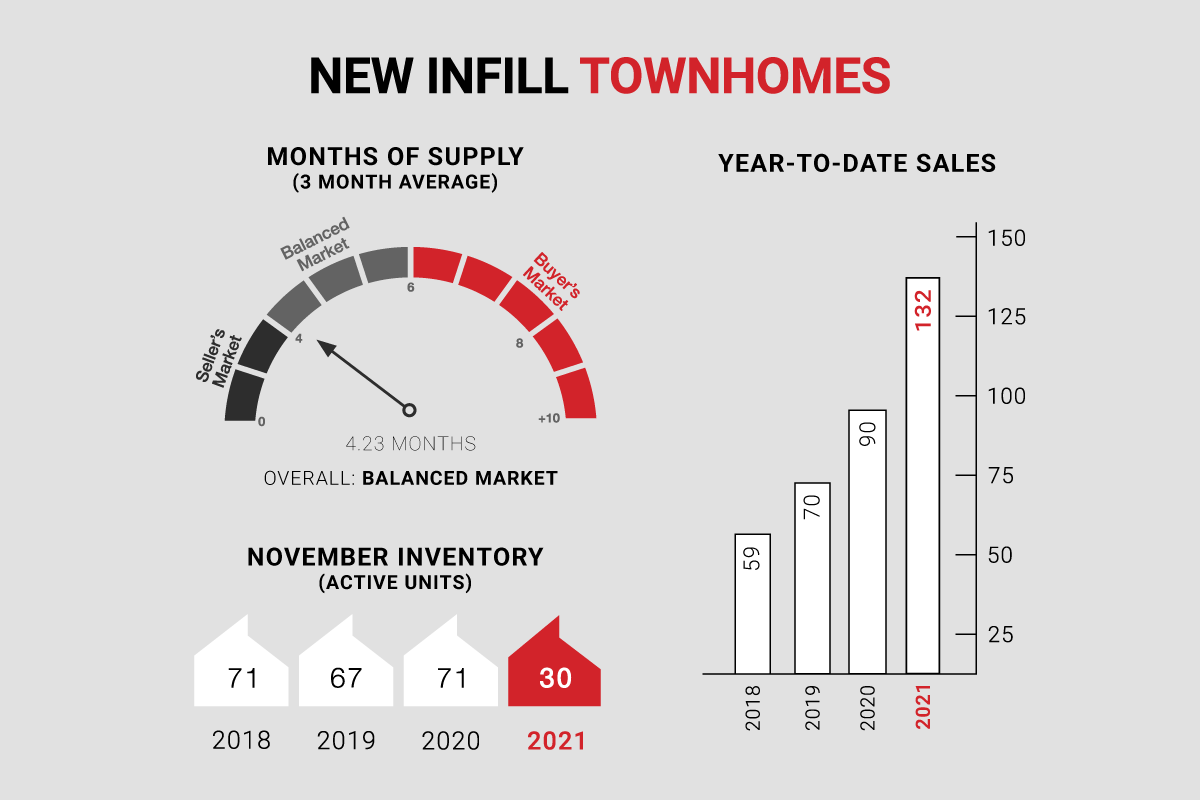

Single family new infills post incredible sales activity during the month of November while new infill townhome inventory reaches lows not seen in years.

Single-family new infills posted an impressive 39 sales during the month of November, almost double last month’s 20 sales, and considerably up the 25 sales recorded in November of last year. Year-to-date sales are up over 29% compared to this time last year.

Single-family new infill inventory has eased, to 148 active listings, from 167 active listings recorded last month and is down for the 160 active listings recorded at this time last year.

New infill townhomes posted 6 sales during the month of November, down from the 11 sales recorded last month and down from the 8 sales recorded in November of last year. Year-to-date sales are up almost 47% compared to this time last year.

New infill townhome inventory has hit another new low for the year, with only 30 active units for sale, down from 35 active units recorded last month and down considerably from the 71 active units recorded at this time last year.

Contrary to what we’ve experienced in the past, new infill sales activity holds strong, even as we head into the holiday season. If this pace keeps up and inventory continues to further decline, new infills will experience a very strong seller’s market in the New Year, likely leading to a rise in prices.

CALGARY MARKET UPDATE (CREB)

City of Calgary, December 1, 2021 - Driven by growth in demand for all property types, there were 2,110 sales in November, just shy of the record for the month set in 2005.

“Lending rates are expected to increase next year, which has created a sense of urgency among purchasers who want to get into the housing market before rates rise,” said CREB® Chief Economist Ann-Marie Lurie.

“At the same time, supply levels have struggled to keep pace, causing tight conditions and additional price gains.”

New listings in November totalled 1,989 units, which was fewer than the number of sales this month. With a sales-to-new-listings ratio of over 100 per cent, inventory levels dropped to 3,922 units and the months of supply dipped below two months.

It is not unusual to see new listings and inventories trend down at this time of year, but slower sales are also typical. Instead, sales have remained at roughly the same levels seen since August.

Persistent demand and slow supply reaction caused the benchmark price to trend up this month to $461,000, an increase compared with last month and nearly nine per cent higher than levels recorded last year.