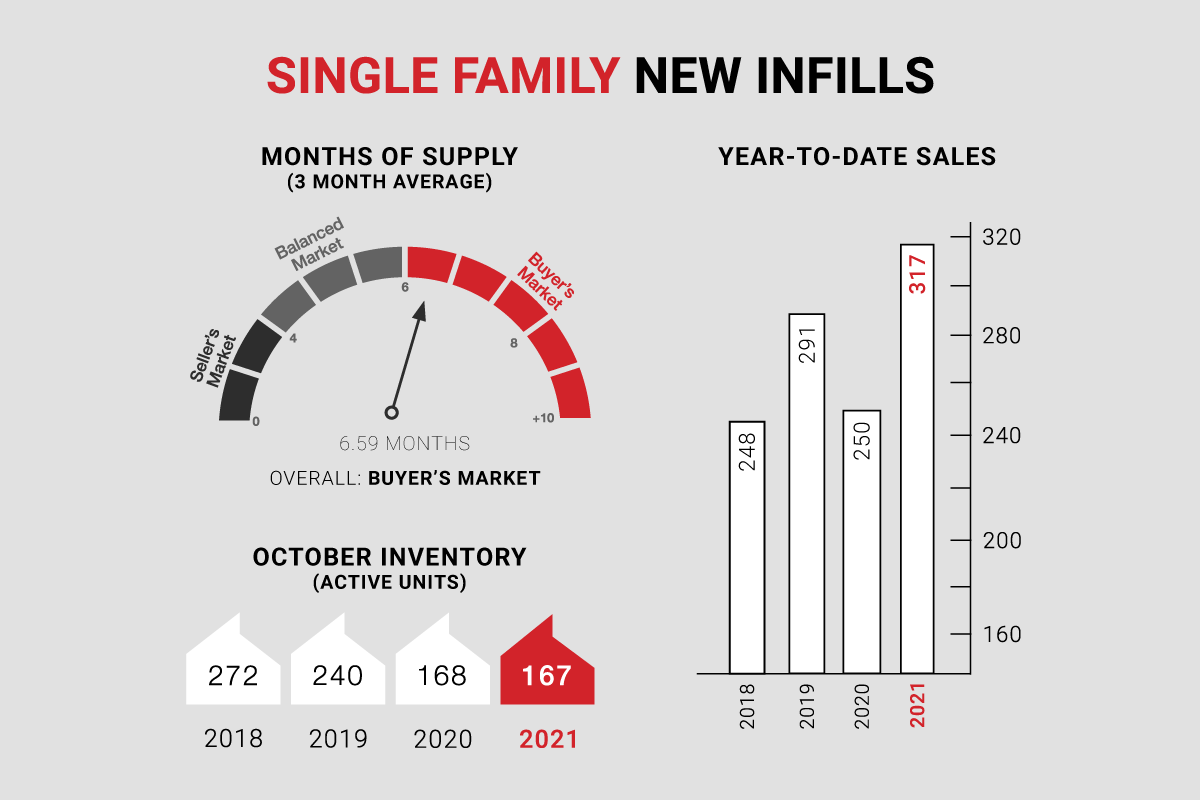

Single-family new infills posted 20 sales during the month of October, slightly below last month's 24 sales and down from the 29 sales recorded in October of last year. Year-to-date sales are still up over 26% compared to this time last year.

Single-family new infill inventory has increased further to 167 active listings from 155 active listings recorded last month. It is now more in line with active listings recorded at this time last year.

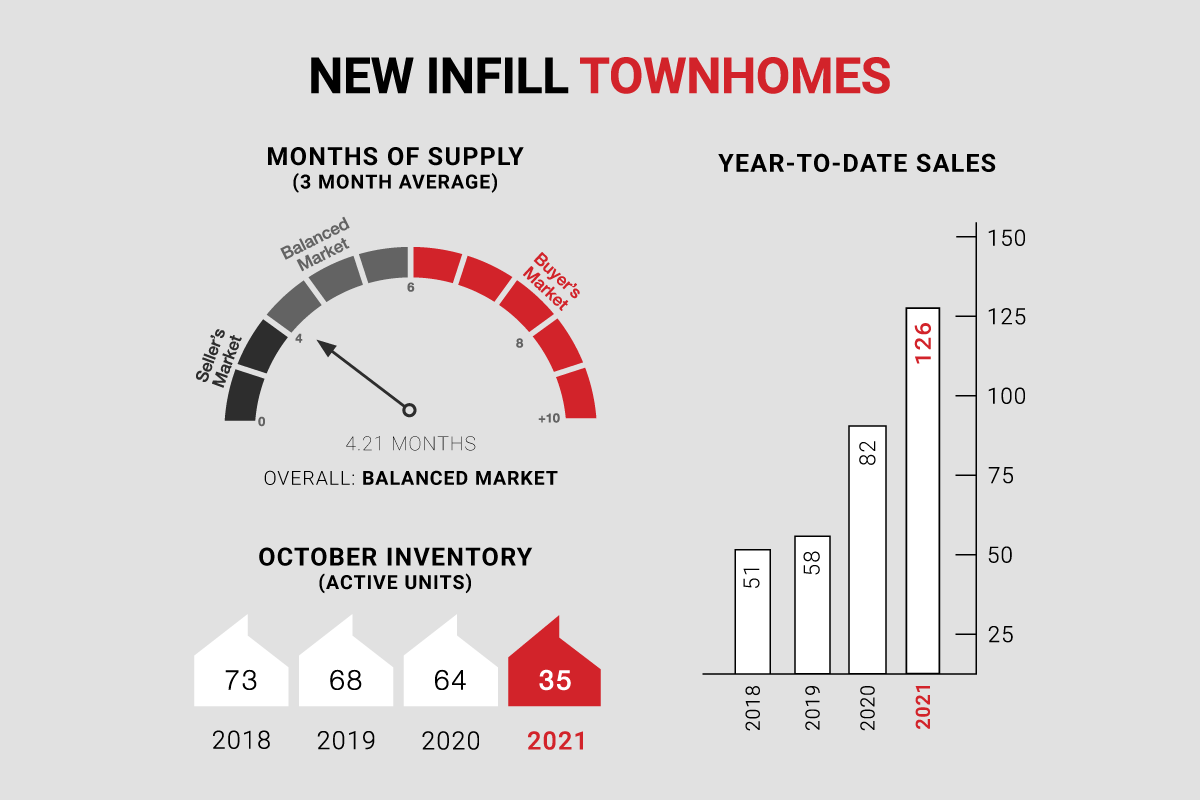

New infill townhome sales edged upwards with 11 sales on record for the month of October, up slightly from the 9 sales recorded last month and up from the 9 sales recorded in October of last year. Year-to-date sales are still up by over 53% compared to this time last year.

New infill townhome inventory has hit a new low for the year with only 35 active units for sale, down from 45 active units recorded last month and down from 64 active units recorded at this time last year.

New infill sales activity is expected to trend downwards as we approach the Holiday Season. This, coupled with declining inventory (until the New Year), generally stabilizes pricing given the balance between demand and supply.

CALGARY MARKET UPDATE (CREB)

City of Calgary, November 1, 2021 - Market continues to favour the seller in October – There were 2,186 sales in October, a record high for the month and over 35 per cent higher than longer-term averages. Year-to-date sales are on pace to hit new record highs and are currently 61 per cent higher than average activity recorded over the past five years and 42 per cent higher than 10-year averages.

“Moving into the fourth quarter, the pace of housing demand continues to exceed expectations in the city,” said CREB® Chief Economist Ann-Marie Lurie.

“Much of the persistent strength is likely related to improving confidence in future economic prospects, as well as a sense of urgency among consumers to take advantage of the low-lending-rate environment.”

New listings have improved relative to last year, but stronger sales caused further easing in inventory levels, which remain 16 per cent lower than last year and longer-term averages for the month. Supply levels have struggled to keep pace with demand, but much of the decline in the months of supply has been related to the strong sales levels. As of October, the months of supply dipped to just over two months.

Persistently tight market conditions did cause some benchmark price gains this month. The benchmark price in October reached $460,100, slightly higher than last month and nearly nine per cent higher than the $422,600 recorded last October.

“Moving into the fourth quarter, the pace of housing demand continues to exceed expectations in the city,” said CREB® Chief Economist Ann-Marie Lurie.

“Much of the persistent strength is likely related to improving confidence in future economic prospects, as well as a sense of urgency among consumers to take advantage of the low-lending-rate environment.”

New listings have improved relative to last year, but stronger sales caused further easing in inventory levels, which remain 16 per cent lower than last year and longer-term averages for the month. Supply levels have struggled to keep pace with demand, but much of the decline in the months of supply has been related to the strong sales levels. As of October, the months of supply dipped to just over two months.

Persistently tight market conditions did cause some benchmark price gains this month. The benchmark price in October reached $460,100, slightly higher than last month and nearly nine per cent higher than the $422,600 recorded last October.